Bitcoin Short-Term Price Rally Possible Amid Positive Coinbase Premium Trends

Bitcoin’s price fluctuations have created bearish sentiment among investors; nonetheless, positive indicators from Coinbase Premium suggest a potential short-term rally. Expert analyses emphasize historical trends of price movements following indicators such as the golden cross, while cautions regarding possible price dips remain pertinent.

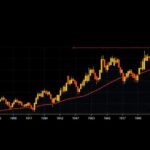

Recent fluctuations in Bitcoin’s price have led to an increase in bearish sentiment among investors and crypto enthusiasts. Nonetheless, a positive trend in Coinbase Premium could indicate a potential short-term price rally for the cryptocurrency. According to information from the on-chain analytics platform, CryptoQuant, there are signs that the Coinbase Premium, a measure of the price difference of Bitcoin on Coinbase versus other exchanges, is showing favorable trends. This is typically interpreted as an indication of increased buying pressure from institutional investors in the United States. In an analysis on the 1-hour time frame of the Coinbase Premium Index, cryptocurrency expert Yonsei Dent suggested that there may be an imminent rally for Bitcoin. He emphasized the importance of employing both 24-hour and weekly moving averages to gauge short-term momentum. Dent pointed out historical trends wherein the formation of a golden cross often precedes brief periods of price increases for Bitcoin. He noted that the current index has temporarily exceeded the weekly moving average, with the gap between the weekly and daily averages continually narrowing, implying a potential price surge on the horizon. Despite this optimistic outlook, there are considerations of a possible price decline before any subsequent rally. Market analyst and enthusiast, Crypto Bullet, cautioned that Bitcoin might descend to the $57,000 range following its recent drop from approximately $66,000 to about $61,000. Crypto Bullet highlighted that the price was trading between $59,000 and $60,000 at the time of his observations. He stated, “We need to take out that Sept 16th low at $57,500 and I believe that $57,000 dip will be the ultimate low for the month.”

The discourse surrounding Bitcoin’s short-term price movements is often shaped by indicators that reflect investor sentiment and demand in the market. Coinbase Premium serves as a critical indicator for discerning the price dynamics across different exchanges, particularly one as influential as Coinbase. Given the unique nature of cryptocurrency markets, even small differences in pricing can signify significant movement from institutional investors, which in turn may affect the broader market environment. Historical patterns, such as the formation of golden crosses in moving averages, have often been cited by analysts as precursors to price rallies, making the current trends particularly noteworthy for stakeholders in the cryptocurrency community.

In conclusion, while Bitcoin’s recent price volatility has raised concerns among investors, the favorable trends indicated by the Coinbase Premium suggest a potential rally could be imminent. Historical patterns support the expectation of upward momentum following specific technical signals, such as the golden cross in moving averages. However, analysts have also warned of the possibility of a temporary price dip before any significant rally takes place, emphasizing the importance of close monitoring of market movements.

Original Source: bitcoinist.com

Post Comment