Is Bitcoin Preparing for a Major Upsurge Towards $65,000?

Bitcoin’s price has recently declined due to geopolitical conflicts but has shown signs of stabilization. Technical analysis highlights a key support at $60,000 and resistance at $64,000. Additionally, on-chain metrics imply potential bullish momentum despite prevailing uncertainties in the market.

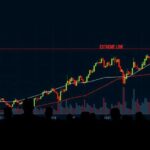

In recent developments, Bitcoin’s price has witnessed a downturn, attributed to geopolitical tensions in the Middle East. However, the cryptocurrency market appears to have stabilized following this decline. Technical Analysis By Edris Derakhshi (TradingRage) Examining the daily chart, it is evident that Bitcoin has recently fallen below the $64,000 threshold and the 200-day moving average. Despite this, the $60,000 support level has proven resilient, allowing for a rebound towards the 200-day moving average. Should the market encounter resistance at this average, a further decline toward the $56,000 and $52,000 levels could be anticipated. On the 4-hour chart, a clear bearish shift in market structure is noted, with a breakdown below the bullish trendline occurring a few days prior. Nonetheless, the establishment of a bottom near $60,000 is evident, as the Relative Strength Index (RSI) has indicated oversold conditions. The next critical factor lies in whether the Bitcoin price can ascend past the $64,000 mark, or if it will face rejection, leading to a deeper decline. On-Chain Analysis By Edris Derakhshi (TradingRage) Bitcoin has experienced a consolidation phase extending over six months, raising questions among market participants regarding the possibility of a cycle top or forthcoming price rallies. Evaluating the Bitcoin Net Realized Profit and Loss (NPRL) metric is pertinent in this context. This metric gauges net profits or losses among investors, where positive values signify profits while negative values indicate losses. Despite the absence of a substantial market crash, the NPRL has contracted to levels reminiscent of when Bitcoin was valued around $30,000 at the onset of the previous bull market. Therefore, barring any significant changes in external factors, it may be prudent to conclude that Bitcoin is poised for a new bullish phase in the near future.

Bitcoin, the leading cryptocurrency, has a volatile market characterized by rapid price changes influenced by global events, investor sentiment, and market indicators. Recent geopolitical tensions in the Middle East have caused fluctuations in Bitcoin’s price, leading to speculation about its next significant price movement. Technical and on-chain analyses serve as critical tools for traders to assess potential market trends and make informed investment decisions.

In summary, Bitcoin’s recent price decline due to external unrest has led to a critical juncture at the $60,000 support level. Technical analysis indicates a crucial resistance point at the $64,000 mark, while on-chain metrics suggest that Bitcoin could be preparing for an upswing if market conditions remain favorable. Investors should watch key levels closely as they may indicate the potential for a return to bullish momentum.

Original Source: cryptopotato.com

Post Comment