Bitcoin Faces Selling Pressure as Coinbase Premium Turns Negative

Bitcoin’s price has dipped to approximately $62,705.97 after briefly surpassing $64,448, with the Coinbase premium reflecting negative momentum since October 1. Analyses reveal persistent selling pressure from retail investors, particularly on exchanges such as Coinbase and Bybit. The situation raises concerns regarding Bitcoin’s ability to maintain its position above key moving averages, signaling potential for further declines if current trends continue.

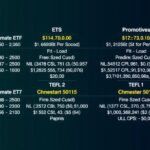

As Bitcoin’s price fluctuates, recently falling to around $62,705.97 after reaching a high of $64,448 on October 7, traders are facing challenges in maintaining bullish sentiments as the cryptocurrency struggles to remain above critical price levels. Despite a promising start at the beginning of October, marked by a surge in prices, the current pullback indicates that bullish control is yet to be established. Data from CryptoQuant indicates that the Coinbase premium has largely sustained a negative trajectory since the beginning of the month, reflecting a decline in retail demand from U.S. investors. A significant drop was noted following a notable spot selling activity on Coinbase and Bybit. This selling pressure positions Bitcoin precariously, where a failure to hold above key moving averages could lead to further bearish trends.

The Bitcoin market has demonstrated volatility, particularly in its pricing trends which directly influence trader sentiment and investment behavior. The Coinbase premium serves as a significant barometer for the demand from retail investors, specifically in the U.S. market. A positive premium historically indicates increased buying enthusiasm, but the current scenario hints at impending selling pressure, suggesting a more cautious retail investor climate. Analysts also observe the dynamics between various exchanges, noting that institutions like Blackrock and Fidelity continue to invest despite bearish tendencies among retail investors.

In summary, the Bitcoin market is currently experiencing a phase of uncertainty, indicated by the negative Coinbase premium and strong selling pressures, particularly from retail traders. The significant inflows into Bitcoin ETFs highlight continued institutional interest, yet retail participation appears restrained. The ability of Bitcoin to sustain above critical price levels, particularly its 50-day and 100-day EMA, will be crucial in determining whether the market can transition into a bullish trend or if further declines are imminent.

Original Source: cointelegraph.com

Post Comment