Predicting Bitcoin’s Price Growth: An Exponential Model Analysis

This article explores the near-exponential growth trajectory of Bitcoin’s price using logarithmic transformation and cubic regression analysis. Through a historical data analysis spanning over thirteen years, the article presents insights into potential future price movements and underscores the effectiveness of statistical modeling in financial forecasting.

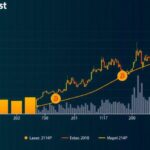

In analyzing the trajectory of Bitcoin’s price, it becomes evident that its growth pattern resembles near-exponential characteristics. By utilizing the logarithmic transformation of Bitcoin’s price data, one can effectively forecast future price movements. This methodology, termed the exponential model, involves taking the natural logarithm of Bitcoin prices and subsequently applying the exponential operator to derive projected values. Logarithms serve as powerful tools for linearizing phenomena characterized by exponential growth; thus, a plot of Bitcoin prices in logarithmic terms typically appears linear. The analysis encompasses over thirteen years of historical data, wherein the logarithm of Bitcoin prices is depicted through an orange line, while the black line illustrates the 90-day weighted moving average (WMA) of the logged price. This moving average technique is employed to mitigate the impact of short-term price fluctuations, thereby revealing more significant, underlying price cycles. For the purpose of fitting a curve to predict future price movements, a cubic function was selected as the best-suited model for this data. Although this choice is somewhat arbitrary, it provides a balance of flexibility and reliability, thereby avoiding the pitfalls of overfitting that can arise from utilizing higher-order polynomials. The goodness of fit for this cubic equation is remarkably high, with a measure of 0.9492, indicating a strong correlation between the model and historical data, where a value of 1 represents a perfect fit.

Bitcoin has been at the forefront of the cryptocurrency market for over a decade, witnessing significant price fluctuations and periods of remarkable growth. Understanding the price behavior of Bitcoin necessitates the use of advanced analytical techniques, especially since its value is influenced by various market dynamics. Employing logarithmic scales in financial analysis is common practice for addressing the complexities associated with exponential growth, exemplified by Bitcoin’s historical price behavior. By studying long-term trends and employing statistical models such as cubic regression, investors and analysts aim to develop insights into potential future price trends for Bitcoin, leveraging historical data to make informed predictions.

In summary, by applying a logarithmic approach to Bitcoin pricing and utilizing a cubic equation for curve fitting, one can establish a credible predictive model regarding the future value of Bitcoin. The method’s effectiveness, as indicated by a high goodness of fit, supports the assertion that Bitcoin’s price may well continue on its current trajectory of near-exponential growth, provided that historical trends remain relevant. This analysis underscores the importance of rigorous statistical methods in financial forecasting and highlights the potential for further price appreciation in the Bitcoin market.

Original Source: www.forbes.com

Post Comment