Bitcoin Price Reaches $64,000: Key Economic Indicators to Monitor This Week

Bitcoin has risen back to $64,000, fostering bullish sentiments and anticipation of an upcoming market rally. Several macroeconomic events, including retail sales and Federal Reserve speeches, could impact the cryptocurrency market this week. Analysts provide mixed predictions on Bitcoin’s future movements, suggesting potential resistance and retracement before any new highs.

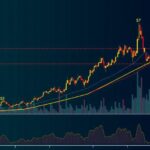

The price of Bitcoin has ascended back to $64,000, reigniting bullish sentiment and prompting expectations for a significant rally often referred to as ‘Uptober.’ This week is marked by several macroeconomic events that investors should closely observe, as they have the potential to influence the cryptocurrency market significantly. Among the critical events, the retail sales data for September is scheduled for release on October 17. This data is crucial as it reflects consumer demand for final goods and offers valuable insights into the health of the U.S. economy. Additionally, it plays a vital role in informing the U.S. Federal Reserve’s decisions regarding interest rate modifications. On the same day, the Philly Fed manufacturing index will also be published, providing a snapshot of the growth within the manufacturing sector. Furthermore, the data on housing starts for September will be disclosed on October 18. The outcomes of these reports are particularly essential amid ongoing speculation about whether the Fed will adjust rates by 25 or 50 basis points, or refrain from making any changes at all. This week, attention should also be directed toward eleven scheduled speeches from Federal Reserve officials. Of note, Fed Governor Christopher Waller is set to speak on October 14, followed by Governor Adriana Kugler on October 15. Their remarks may offer critical insights into the Federal Reserve’s current stance, whether it leans towards a dovish or hawkish approach, particularly in anticipation of the forthcoming FOMC meeting in November. Moreover, several prominent companies listed on the S&P 500, including financial institutions like Morgan Stanley, Goldman Sachs, and Citigroup, will report their earnings this week. Given Bitcoin’s historical correlation with the stock market, favorable earnings results from these companies could potentially enhance a positive outlook for Bitcoin and the wider cryptocurrency market. As Bitcoin trades at approximately $63,900, up nearly 2% within the last twenty-four hours, questions arise regarding whether this signifies a return to a bullish market. According to analyst Ali Martinez, for Bitcoin to confirm a bullish reversal, it must successfully break above the $66,000 threshold. He anticipates a potential rise to that level, followed by a decline below $60,000, and possibly a retracement towards $57,000 before making a push towards $78,000, which would represent a new all-time high, surpassing the current ATH of $73,000. Conversely, analyst CrediBULL Crypto cautions that it may not yet be prudent to embrace a bullish outlook and suggests a possibility of Bitcoin dropping below $50,000 prior to reaching new record levels.

In recent weeks, the price of Bitcoin has seen fluctuations that resonate with traders and investors alike. The current price point of $64,000 draws attention not only for its significance in the context of Bitcoin’s historical performance but also because of the surrounding economic events that might sway its trajectory. Macro indicators such as retail sales, manufacturing data, and Federal Reserve statements provide informative context that can influence both market sentiment and decision-making within the crypto space. Furthermore, the performance of traditional financial institutions could serve as a barometer for Bitcoin’s prospects, reinforcing the interconnectedness of these markets.

The recent surge of Bitcoin above $64,000 has fostered optimism concerning a potentially bullish market phase. Nevertheless, several pivotal macroeconomic events this week merits close scrutiny as they could significantly affect market conditions. Key data releases related to retail sales and manufacturing, along with insights from Federal Reserve speakers, may provide clarity on future movements for Bitcoin. Analysts suggest that while there is potential for further upward movement, caution is advised, particularly as the market remains sensitive to both local and global economic indicators.

Original Source: bitcoinist.com

Post Comment