Google Search Ceases to Display Cryptocurrency Pricing Charts, Amid Decline in Bitcoin Interest

Google Search has stopped providing direct access to Bitcoin and cryptocurrency price charts, diverting users to Google Finance instead. This change follows a notable decline in search volume for Bitcoin, hitting a yearly low, which may indicate waning public interest. Experts suggest that historically, such lows have preceded significant price increases for Bitcoin, prompting a reevaluation of investment strategies during these periods.

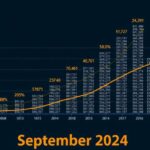

Recently, Google Search has ceased to display real-time charts for Bitcoin and other cryptocurrencies, a significant shift from its previous practice. While users can no longer retrieve these charts directly through a standard search, access remains available via Google Finance. Reports from various users on X indicate that queries regarding Bitcoin’s price resulted in a lack of chart outputs, a stark contrast to the continued availability of stock price charts in search results. This decision has fueled speculation among the cryptocurrency community regarding its implications. Some analysts interpret this change as a potentially positive signal for Bitcoin, suggesting that traditional financial systems may feel insecure due to the burgeoning influence and growth of cryptocurrencies. Historically, Google facilitated users in monitoring cryptocurrency prices by displaying live charts, allowing quick access to essential financial data without the necessity to visit specialized financial websites. This move by Google marks a notable departure from that approach. Additionally, it is noteworthy that the search volume for Bitcoin reached a year-low in the week of October 12, 2024. By the end of that week, the global interest level for the term diminished to a mere 33 out of a possible 100. According to Ryan Lee, the chief analyst at Bitget Research, this significant drop in search interest has happened before, notably in early 2024, preceding a substantial increase in Bitcoin’s price from $41,000 to nearly $71,500 within six weeks. Lee elaborated on the concept of market timing, stressing that the stagnant market period from May to September 2023 provided an optimal environment for accumulating positions in anticipation of future price surges. He suggests that such strategies, particularly when Bitcoin search volumes are low and interest is sparse, are rational and potentially fruitful.

The fluctuation in the visibility of Bitcoin pricing charts on Google Search represents a larger trend in the intersection of technology and finance, particularly regarding how cryptocurrencies are perceived and engaged with by the general public. Google previously allowed users direct access to cryptocurrency pricing, which provided real-time market transparency. The current cessation of this service may indicate a shift in how tech giants view the security and legitimacy of cryptocurrency as an asset class, especially as traditional financial markets and cryptocurrencies continue to evolve side by side. Furthermore, the decline in search interest in Bitcoin signifies a potential waning of public enthusiasm, potentially influencing Bitcoin’s pricing and market dynamics as critical indicators for traders and investors.

In summary, Google’s recent withdrawal of cryptocurrency price charts from its search results has sparked significant debate within the financial and crypto communities. While some view this as an adverse signal for cryptocurrencies, it may also reflect the ongoing evolution of market dynamics as traditional institutions contend with the rise of digital currencies. The concurrent drop in Bitcoin search volume, indicative of decreased public interest, suggests potential price implications in the near future, particularly as historical trends indicate a pattern of recovery following similar lows. As such, market participants may need to reconsider their strategies in light of these developments.

Original Source: cryptonews.com

Post Comment