Current Bitcoin Price and Investment Insights as of October 2024

On October 15, 2024, Bitcoin is valued at $65,766.47, up 1.42% from the previous day, with a market cap of over $1.1 trillion. Its price rises significantly over the past month (+8.66%) and year (+56.63%). Despite its growth, Bitcoin’s price remains volatile, influenced by various factors, including economic conditions and regulatory developments. Investment options include purchasing Bitcoin, Bitcoin IRAs, ETFs, and cryptocurrency-related stocks.

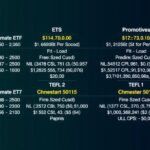

As of October 15, 2024, Bitcoin, the pioneering cryptocurrency, maintains its status as the leading digital currency with a market capitalization exceeding $1.1 trillion. Currently, the price of one Bitcoin (BTC) is recorded at $65,766.47, reflecting an increase of 1.42% from the previous day. Over the past month, Bitcoin’s value has escalated by 8.66%, and year-on-year, it has surged by an impressive 56.63%, having been valued at $28,522.10 just a year ago. Originally designed as a mechanism for payments, Bitcoin has evolved into a popular investment asset, appealing to individuals seeking to diversify their portfolios with alternative assets. The appeal of cryptocurrencies, particularly as a hedge against inflation, has gained momentum as Bitcoin has demonstrated substantial growth, outpacing the gains seen in major stock indices. Coinbase, a prominent cryptocurrency exchange, reported a quarterly trading volume of $226 billion and offers access to over 200 cryptocurrencies. Bitcoin’s journey since its inception in 2009 has been remarkable. A historical anecdote exemplifying its value transformation involves Laszlo Hanyecz, who infamously traded 10,000 Bitcoins for two pizzas—a transaction that would be worth over $580 million today. By early 2024, Bitcoin’s price reached $44,187, peaking at over $73,079 in March 2024, demonstrating its volatile nature. According to Drew Feutz, a certified financial planner, “The potential benefits of investing in crypto are potentially higher returns than a more traditional stock and bond portfolio may yield on its own.” Nevertheless, investors should be aware that Bitcoin is susceptible to significant price fluctuations, having dropped to approximately $58,000 in September 2024. Factors influencing Bitcoin’s price include its acceptance as a payment method by major corporations, the overall economic climate, and evolving regulatory frameworks surrounding cryptocurrencies. For instance, positive announcements about companies adopting Bitcoin typically lead to price surges. Furthermore, Bitcoin tends to thrive during periods of economic stability, resulting in increased investor confidence. Investing in Bitcoin can be pursued through various channels, including purchasing directly via cryptocurrency exchanges, establishing a Bitcoin IRA for tax-advantaged investments, investing in cryptocurrency-related ETFs, or buying shares of companies involved in the crypto sector. While Bitcoin demonstrates remarkable past performance, its future remains uncertain, with experts predicting significant price potentials for 2030, ranging from $400,000 to $1 million per Bitcoin. However, as stated by Feutz, it is advisable to keep cryptocurrency investments to a maximum of 5% of one’s portfolio due to inherent volatility.

Bitcoin is the first cryptocurrency, introduced in 2009. It has developed into not just a medium of exchange but rather an asset class that has attracted intense interest from both individual and institutional investors amid its substantial price appreciation. Factors such as inflation fears, technological developments, and increasing acceptance by businesses have propelled Bitcoin to mainstream attention. With Bitcoin’s past volatility and its ongoing debate about utility versus investment, understanding its market dynamics is essential for current and prospective investors.

In summary, Bitcoin remains a key player in the cryptocurrency market, marked by significant price increases and strong investor interest. While it demonstrates a potential for high returns, investors should exercise caution due to its inherent volatility. Investing progressively, keeping Bitcoin as a small percentage within a diversified portfolio, is prudent. The cryptocurrency landscape is still evolving, and as acceptance grows, Bitcoin may continue to mature into a more stable investment option.

Original Source: fortune.com

Post Comment