Bitcoin Price Forecast: BTC Eyes $70,000 Amid Strong Institutional Interest and Volatility Concerns

Bitcoin has stabilized around $67,000, bolstered by institutional demand evidenced by substantial inflows into U.S. Bitcoin spot ETFs. Concurrently, Tesla’s recent transfer of $760 million worth of Bitcoin creates uncertainty regarding market sentiment. Analysts predict heightened volatility ahead, driven by fluctuating supply and demand dynamics, as BTC aims for a target of $70,000, contingent upon maintaining support at $66,000.

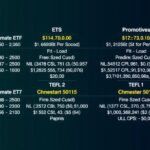

Bitcoin (BTC) has shown strong performance recently, trading around $67,000 after solidifying above $66,000, a crucial psychological support level. Institutional demand remains robust, evidenced by over $373 million in inflows into U.S. Bitcoin spot exchange-traded funds (ETFs) recorded on Tuesday, marking a second consecutive day of inflows. Nonetheless, there are concerns stemming from Tesla’s transfer of $760 million worth of Bitcoin to other wallets. The interpretation of this transfer is ambiguous, raising questions regarding whether it is merely internal movement or a potential sale. Additionally, a report from Glassnode highlights a worrying imbalance between supply and demand for Bitcoin, indicating a likely uptick in volatility in the near future. Despite the uncertain sentiment generated by Tesla’s actions, institutional interest appears to be strengthening. The influx of capital into Bitcoin ETFs suggests a burgeoning appetite from institutional investors and may help propel BTC towards its July high of $70,079, especially if support at the $66,000 threshold remains intact. Technical indicators such as the Moving Average Convergence Divergence (MACD) signal a positive trend, and the Relative Strength Index (RSI) approaches overbought territory, suggesting a cautious but potentially fruitful bullish sentiment. However, should Bitcoin fail to hold the $66,000 support, a decline to the $62,000 mark is conceivable, aligning with the 61.8% Fibonacci retracement level. Investors display a relatively high level of confidence compared to previous market conditions, despite a slightly adverse sentiment prevalent due to the market’s volatility. This evolving situation necessitates careful observation of market trends and dynamics as they unfold, particularly regarding new capital inflows and overall investor behavior.

Bitcoin, the world’s largest cryptocurrency by market capitalization, has been experiencing fluctuations in its price influenced by various factors. Of notable significance is the activity surrounding U.S. Bitcoin spot ETFs, which serve as key indicators of institutional market sentiment. This article centers on the recent price movements of Bitcoin and the factors influencing its volatility, including institutional investments and significant wallet transfers by large stakeholders like Tesla. Additionally, supply-demand dynamics identified by various metrics further complicate the landscape, suggesting impending market movements and potential price corrections. Understanding these elements is fundamental for comprehending Bitcoin’s current standing and future trajectory in the volatile cryptocurrency market.

In summary, Bitcoin is currently positioned at approximately $67,000, having successfully navigated above a critical resistance point of $66,000. Institutional interest, as reflected in substantial ETF inflows, underlines a positive sentiment towards the cryptocurrency, even amid uncertainties triggered by significant cryptocurrency transfers involving entities like Tesla. However, analysts warn of potential volatility driven by the declining supply and fluctuating demand dynamics. Maintaining support around $66,000 will be crucial for Bitcoin to continue its upward trajectory towards the $70,000 target. Conversely, failure to uphold this support could lead to retracement towards lower price levels, warranting caution amongst traders and investors alike.

Original Source: www.fxstreet.com

Post Comment