Bitcoin Traders Face Market Caution Amid Jobless Claims and Rate Cut Speculations

Bitcoin’s price is currently around $67,000, experiencing a slight decline after reaching $68,400. Recent US jobless claims data has affected market confidence in interest rate cuts by the Federal Reserve, which are now anticipated to be modest. Traders are focusing on the impending US Presidential Election as a key market driver, while mixed opinions persist regarding Bitcoin’s price trajectory in the near term.

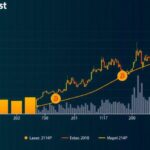

As of October 17, Bitcoin (BTC) is trading at approximately $67,000, having declined from an 11-week peak of $68,400 due to market reactions to recent US employment data. The release indicated a larger than expected rise in ongoing jobless claims, which tempered investor expectations regarding imminent interest rate cuts by the Federal Reserve (Fed). Current estimates suggest a 0.25% reduction in rates is likely to occur during the Fed’s upcoming meeting in November, supported by data from CME Group’s FedWatch Tool. In contrast, the European Central Bank (ECB) executed a scheduled 0.25% interest rate cut on the same day. Amidst these developments, the Bitcoin community is now pivoting its focus toward the forthcoming US Presidential Election, anticipated to coincide with the Fed meeting, as a crucial market catalyst. QCP Capital pointed out that “While the US election is the next key catalyst for BTC and crypto, markets remain uncertain as to where BTC will go post election.” This transition in focus is also reflected in the trading behavior of options expiring around the election, which are currently trading at a 10% premium. Market analysts are divided on the possible direction of BTC prices in the short term. TheKingfisher indicated that potential resistance may arise at around $71,300, with a trading range forecasted between $60,200 and $71,300. Key liquidity levels have been observed at approximately $68,000, with expectations for Bitcoin to consolidate above significant moving averages before making a substantial move toward the $70,000 threshold. Keith Alan from Material Indicators emphasized that “Bulls want to see price stay above the key MA’s,” advocating for a healthy consolidation phase before pursuing higher price targets. As the market navigates through these dynamics, the discussions surrounding Bitcoin’s price trajectory have become increasingly nuanced, with investors keenly awaiting both macroeconomic cues and political developments.

Bitcoin, a leading cryptocurrency, is currently experiencing fluctuating market conditions, influenced by various macroeconomic factors including employment data and central bank monetary policies. The recent rises and subsequent declines in its price can largely be attributed to shifts in investor sentiment regarding potential interest rate cuts by the Federal Reserve. This situation is compounded by the proximity of the US Presidential Election, which is expected to further impact market dynamics and investor behavior in the crypto sphere.

In summary, the current price of Bitcoin remains under scrutiny as it hovers around $67,000, following slight declines after hitting 11-week highs. Market practitioners are closely monitoring economic indicators and political events that may influence Bitcoin’s future movements. The upcoming US Presidential Election and Federal Reserve meeting are pivotal events that could sway market confidence and trading strategies. Analysts suggest a cautious approach, advocating for consolidation above key price levels before any significant upward movement toward $70,000 occurs.

Original Source: cointelegraph.com

Post Comment