Forecasting Bitcoin’s Future: An Analysis of Annualized Rates of Return

This article discusses forecasting Bitcoin’s price using annualized rates of return, with a focus on understanding the impact of different AARs over various timeframes. It emphasizes the volatility of Bitcoin and the limitations of singular price estimates, while also contemplating the implications of continued price appreciation on the broader economic landscape.

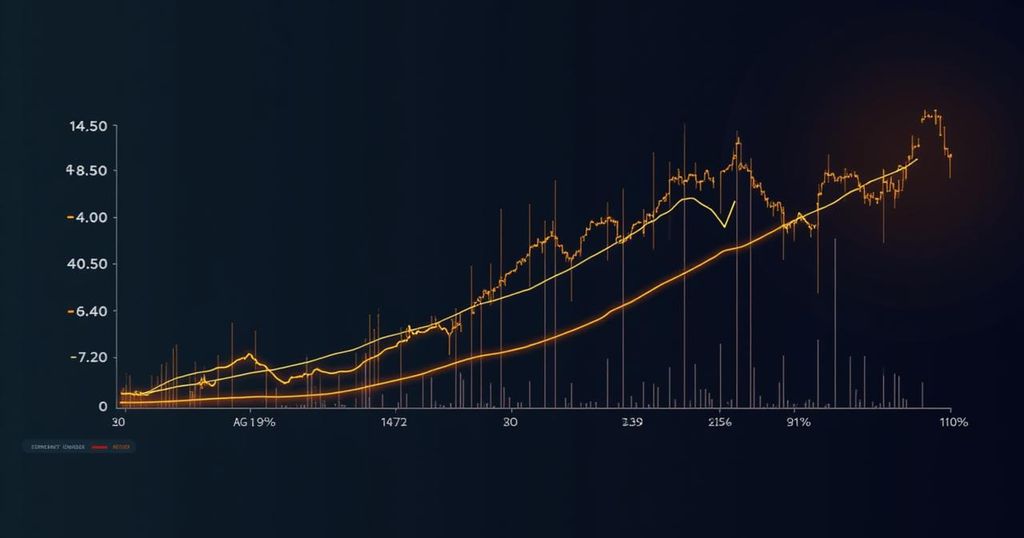

In consideration of Bitcoin’s price forecasting, the annualized rates of return (AAR) serve as a practical tool for projecting future values. As discussed during the Bitcoin 2024 conference in Nashville, an AAR of 29% was proposed as a baseline scenario. By establishing Bitcoin’s price on August 1, 2024, as the initial reference point, we can evaluate various annualized rates of return and observe how Bitcoin’s price might progress over the subsequent four years. It is crucial to recognize that Bitcoin’s notorious volatility renders any singular price estimate precarious; therefore, one should view these projections as guidelines to understand potential terminal prices as of August 1, 2028. While the predicted returns may appear elevated compared to traditional asset returns—such as equities averaging 8% or Warren Buffett’s portfolio at 22%—they remain considerably lower than Bitcoin’s historical annual returns. The projection illustrates the significant impact of compounding annual rates of return, highlighting how even marginal variations in these rates can lead to substantial differences in terminal wealth over extended periods, including a forecast extending up to 20 years. After examining the data, one notes that Bitcoin’s average returns over shorter durations tend to lag compared to those over longer horizons, suggesting that initial returns may be poorer than those realized in the latter years. Thus, focusing on the terminal value, rather than intermediate returns, is paramount. The simplicity of using rates of return provides a familiar framework for investors, yet the chosen rate of return heavily dictates future price trajectories. Variations in Bitcoin’s return exist based on time windows and purchase/sale dates; strategic market timing can significantly impact reported returns. Skeptics often assert that Bitcoin’s past performance cannot foretell future prospects, especially given that anomalous conditions contributing to earlier price surges are unlikely to reoccur, such as the historic issuance of 50 bitcoins per block. However, the substantial returns exhibited during Bitcoin’s nascent years suggest that even conservative forecasts now may yield outputs surpassing those of traditional assets. The relevant inquiry may not center on the potential collapse of Bitcoin’s value, but rather the implications if its appreciation persists. Future articles will delve into how Bitcoin may critically transform economic structures in contemporary society.

The article elaborates on the methodology for forecasting Bitcoin’s future price utilizing annualized rates of return (AAR). By referencing historical data and future projections, it seeks to provide insights into Bitcoin’s price trajectory over various timeframes and its inherent volatility. The discussion stems from presentations at the Bitcoin 2024 conference, emphasizing both the benefits and limitations of employing historical ROI for projection purposes. Additionally, the article examines the general narrative surrounding Bitcoin’s past growth while contemplating the significance of its future performance in the broader financial landscape.

The analysis underscores the importance of annualized rates of return in predicting Bitcoin’s future prices. It highlights the extreme volatility inherent in Bitcoin and cautions against treating any singular price estimate as definitive. The varying returns depending on the timeline demonstrate the significance of considering long-term forecasts. The potential for Bitcoin to continue appreciating raises intriguing questions about its future role in the economy, necessitating further examination and discourse.

Original Source: www.forbes.com

Post Comment