Cryptocurrency Market Update: Bitcoin and Altcoins Set to Surge

The cryptocurrency market is experiencing upward momentum, highlighted by Bitcoin trading around $68,400 after significant inflows into spot ETFs. Bitcoin’s open interest has reached record levels, supported by increasing whale activity, while several projects are set to unlock over $400 million in coins this week. With total market capitalization rising to $2.39 trillion and sentiment in the greed range, the outlook remains positive for major cryptocurrencies.

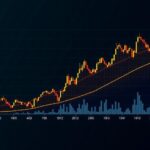

The cryptocurrency market is currently witnessing positive momentum, with Bitcoin (BTC) hovering around $68,400. This follows a substantial surge of 9.8% in the previous week, driven by an impressive inflow of $2.13 billion into US-based spot Exchange Traded Funds (ETFs). Favorable on-chain indicators indicate a bullish scenario, as Bitcoin’s open interest has reached a historic high of over $40 billion in conjunction with a notable rise in whale wallets. The anticipation regarding the SEC’s potential approval of Bitcoin ETF options on the NYSE highlights the increasing liquidity and the likelihood of sustained investments, supporting the ongoing narrative of a thriving “Uptober.” Moreover, several prominent crypto projects, including Solana (SOL), Worldcoin (WLD), and Bittensor (TAO), are poised to unlock over $400 million in cryptocurrencies this week, as indicated by data from Tokenomist.ai. Overall, the cryptocurrency market demonstrates resilience with its total market capitalization rising over 7% this past week to reach $2.39 trillion—the highest level recorded since late July. Concurrently, the Cryptocurrency Fear and Greed Index remains in a state of greed, positioning between 71 and 73 for six consecutive days, reminiscent of the market’s behavior observed in late July. In further noteworthy developments, ApeCoin (APE) has recorded a remarkable 70% surge following the launch announcement of a new cross-chain bridge, ApeChain, facilitating the transfer of APE tokens between the Ethereum and Arbitrum networks. The price of Bitcoin is approaching a critical resistance level at approximately $70,000. A decisive close above this threshold may ignite a rally towards its all-time high of $73,777. Additionally, Bitcoin’s performance reflects an increase in institutional demand, as evidenced by $1.86 billion in net inflows this week—the largest influx observed since mid-July. This uptick corroborates the sentiment surrounding the potential for Bitcoin reaching new heights.

The cryptocurrency landscape has seen significant changes recently, particularly with Bitcoin’s performance and the upcoming potential of various crypto projects. As investment vehicles like Bitcoin ETFs become more mainstream and the market capitalization reaches significant levels, understanding trends, market sentiments, and unlock events of cryptocurrencies becomes crucial for investors. This context is vital in assessing where Bitcoin stands in relation to its past highs while also considering the broader implications of project-specific coin unlocks and institutional involvement in the market.

In conclusion, the current dynamics within the cryptocurrency market exhibit a positive trajectory, propelled primarily by Bitcoin’s strong performance and the unlocking of significant value within several projects. The prospects for Bitcoin to attain its previous all-time high is bolstered by institutional interest and market sentiment edging toward greed. Investors should carefully consider these developments while remaining mindful of the inherent risks associated with market fluctuations.

Original Source: www.fxstreet.com

Post Comment