Current Overview and Insights on Bitcoin Pricing and Investment Strategies as of October 2024

As of October 21, 2024, Bitcoin is priced at $68,148.89, showing a slight decline of -0.17% from the previous day. With a market cap of over $1.1 trillion, Bitcoin’s performance has outpaced traditional stocks, demonstrating a yearly increase of 55.77%. Various investment methods are available, including direct purchases, Bitcoin IRAs, and cryptocurrency ETFs. While Bitcoin’s volatility presents challenges, its status as an investment asset is on the rise, appealing to many investors seeking diversification.

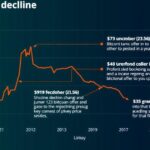

As of October 21, 2024, Bitcoin, the foremost cryptocurrency in the market, possesses a market capitalization surpassing $1.1 trillion, with a current price of $68,148.89 per Bitcoin, marking a marginal decline of -0.17% compared to the previous day’s price of $68,263.42. Over the past month, Bitcoin’s price has increased by 7.86% from $62,795.57, and when viewed over a year, it reflects a significant gain of 55.77% from last year’s price of $30,140.68. The evolution of Bitcoin has transitioned from a means of payment to an investment asset, particularly appealing for those seeking alternatives within their investment portfolios. Many investors perceive Bitcoin as a hedge against inflation and a means to diversify their holdings. The cryptocurrency’s remarkable growth has outperformed many traditional stock market indices, demonstrating its rising attractiveness. Bitcoin’s journey began in 2009, and it has witnessed unprecedented price growth. The most notable historical citation is when Laszlo Hanyecz infamously paid 10,000 Bitcoins for two pizzas in 2010, which would now be valued at over $580 million. Currently, Bitcoin’s price fluctuates considerably, influenced by various market forces, such as the adoption of Bitcoin by major corporations, general economic conditions, and the evolving regulatory landscape around cryptocurrencies. Potential investors have several avenues for investing in Bitcoin, including purchasing directly through cryptocurrency exchanges, opening Bitcoin IRAs, investing in cryptocurrency ETFs, or purchasing stocks of companies engaged in the cryptocurrency sector. Although Bitcoin showcases volatility, some experts, such as Brady Swenson, argue that its price stability is improving as liquidity increases. Other cryptocurrencies, such as Ethereum, Tether, and Binance Coin, also present investment opportunities, each catering to different investor needs and risk appetites. Ethereum, for example, serves as a decentralized computing platform, while Tether offers stability as a stablecoin tied to the U.S. dollar, and Binance Coin supports transactions on the Binance exchange. Despite Bitcoin’s volatile nature, its extended growth trajectory suggests significant potential, particularly as companies increasingly embrace the technology and it gains broader acceptance as a means of payment. Experts recommend maintaining a diversified portfolio and limiting cryptocurrency investments to a maximum of 5% of one’s overall investment strategy.

Bitcoin stands as the first and most recognized cryptocurrency, introduced in 2009, and has since garnered attention for its extreme price volatility and substantial returns over the years. Its journey reflects significant milestones, such as the infamous pizza purchase with Bitcoin and its ongoing status as a popular investment asset. As Bitcoin contrasts traditional stocks, understanding the factors influencing its value is crucial for prospective investors. Today, various investment options exist in the cryptocurrency space, including Bitcoin IRAs and cryptocurrency ETFs, catering to different investor profiles and risk tolerances. With major companies beginning to accept Bitcoin as a payment method and the development of regulatory frameworks, the market’s dynamics continue to evolve.

In conclusion, Bitcoin has not only demonstrated remarkable price appreciation since its inception but also serves as a catalyst for alternative asset investment. With significant growth potential and evolving market narratives, Bitcoin continues to attract investors. However, the inherent volatility necessitates a cautious approach. Experts advise that prospective investors should conduct thorough research, consider their investment horizon, and maintain diversified portfolios to mitigate risks associated with cryptocurrency investments.

Original Source: fortune.com

Post Comment