Bitcoin Price Shows Bullish Recovery Signs Amid Whale Accumulation and Institutional Interest

Bitcoin is currently attempting a bullish recovery towards the $68,000 mark, bolstered by substantial accumulation from whale investors, alongside evolving institutional interests and geopolitical circumstances. While short-term fluctuations may pose challenges, the overall sentiment remains cautious yet optimistic about future price gains.

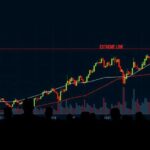

As Bitcoin (BTC) strives for a bullish recovery, approaching the $68,000 mark, significant involvement from whale investors has played a crucial role in reigniting optimism within the cryptocurrency sector. Recent activities have demonstrated increased accumulation of Bitcoin by these large holders, suggesting anticipation of a forthcoming price rally. Currently, Bitcoin has oscillated around the previous all-time high of nearly $69,000, recently attempting to rebound after a slight dip to $66,600. The cryptocurrency is now experimenting with volatility, with notable sell-offs resulting in approximately $200 million being liquidated in leveraged positions, predominantly impacting long traders. Despite potential for a short-term pullback below the critical support level of $64,600, analysts remain optimistic about a rebound beyond the $70,000 threshold, provided Bitcoin maintains a consistent closing above $69,000 in the forthcoming days. The sentiment for a broader bullish trend in the cryptocurrency market is further supported by gains in altcoins and meme coins. In addition, the looming 2024 U.S. election and expected Federal Reserve rate cuts have spurred increased Bitcoin accumulation as a hedge against economic uncertainty, amid heightened global geopolitical tensions affecting fiat currencies. On-chain data has revealed a significant drop in Bitcoin supply on centralized exchanges, coinciding with an influx of approximately $294 million into U.S.-based spot Bitcoin ETFs, particularly highlighting BlackRock’s substantial cash flow momentum of $329 million. Accordingly, with the market evolving rapidly, stakeholders are encouraged to stay informed and proactive in their investment decisions.

The current landscape surrounding Bitcoin and the broader cryptocurrency market reflects a confluence of factors including investor behavior, market volatility, institutional participation, and geopolitical influences. Whale investors—entities or individuals holding large quantities of Bitcoin—have shown a continued propensity to accumulate, fostering a climate of bullish sentiment despite the inherent volatility of the market. Recent prices have demonstrated fluctuations just below historical highs while being closely monitored for potential breakout scenarios. Institutional investment, notably from entities such as BlackRock and Fidelity, has become a significant component of Bitcoin’s market dynamics, particularly with the rising adoption of Bitcoin ETFs designed to broaden access to this asset class. Furthermore, macroeconomic elements such as inflation, changes in monetary policy, and geopolitical tensions contribute to Bitcoin’s perceived role as a hedge against traditional financial instability, making this a pivotal moment for market engagement.

In summary, Bitcoin’s recent performance reflects a mixed outlook characterized by underlying support from whale investors amidst broader market volatility and geopolitical tensions. The sustained accumulation by institutional investors points to a strategic shift toward Bitcoin as a hedging mechanism amidst market uncertainty. Observing key price levels and external economic factors will be essential for anticipating Bitcoin’s trajectory in the near term. As the cryptocurrency landscape evolves, stakeholders must remain vigilant and well-informed as they navigate potential opportunities within this dynamic market.

Original Source: www.coinspeaker.com

Post Comment