Bitcoin Hashrate Reaches Record as Price Experiences Downward Trend

On October 21st, Bitcoin’s hash rate hit a record high of 769.8 EH/s, showcasing enhanced network security. Despite this, Bitcoin’s price fell to below $67,000 due to economic factors, putting pressure on miners as profitability declines. Publicly traded mining firms are increasing their control over the market, while observers are focused on macroeconomic influences ahead of significant U.S. developments.

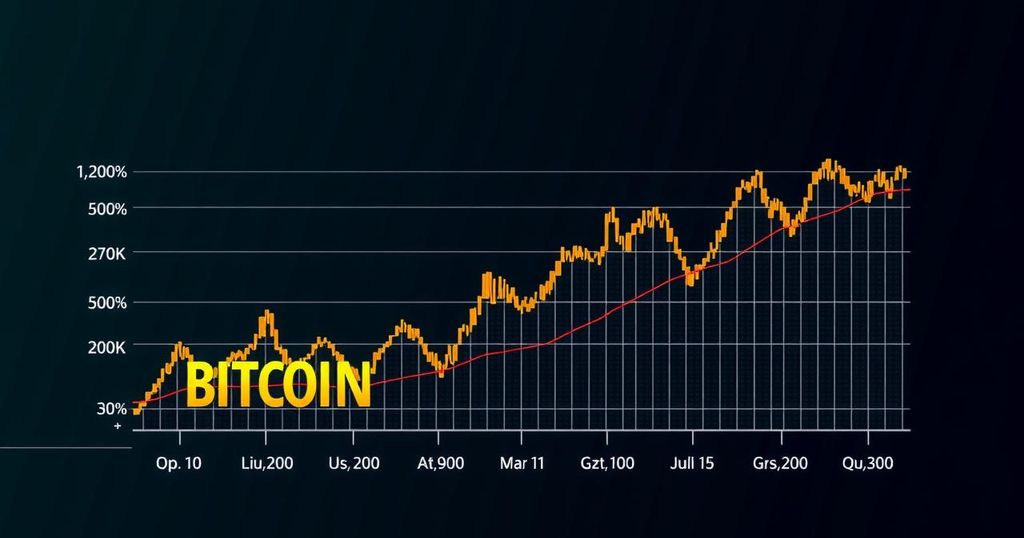

As of October 21st, Bitcoin’s hash rate reached an all-time high of 769.8 exahashes per second (EH/s), according to data from BitInfoCharts. This remarkable rise reflects an improved security posture for the Bitcoin network, as a higher hash rate generally enhances resilience against potential malicious attacks. The growth in hash rate can largely be credited to the increasing presence of publicly traded mining firms, which possess the necessary financial leverage to invest in advanced mining technologies and scale their operations effectively. Conversely, the price of Bitcoin has encountered setbacks, slipping below the $67,000 mark on October 22nd in U.S. morning trading. This decline follows an unsuccessful attempt to surpass the $70,000 resistance level and has resulted in Bitcoin lagging behind other leading cryptocurrencies such as Ethereum and Litecoin. Analysts attribute the price drop to escalating interest rates in Western economies and uncertainties surrounding forthcoming U.S. earnings reports, which may be impacting market sentiment. Despite the hash rate growth indicating a stronger network, it complicates the situation for miners, particularly smaller entities. The increase in computational difficulty associated with the rising hash rate presents heightened operating costs, placing profit margins under pressure—especially in light of the recent Bitcoin halving that reduced block rewards. Although Bitcoin mining profitability saw a temporary spike in August, reaching $50 per petahash per second (PH/s) primarily from increased transaction fees, it has since diminished, with forecasts from Jefferies indicating a tough October ahead for miners. Publicly traded mining companies are steadily consolidating their position within the Bitcoin mining landscape, currently accounting for nearly 29% of the total network hash rate. Their financial strength allows them to adeptly navigate the volatility of the market, thereby positioning themselves for potential growth and a larger share of the market. The cryptocurrency sector is keenly observant of the upcoming U.S. elections and broader macroeconomic trends, as these elements could significantly influence Bitcoin’s pricing trajectory and overall mining profitability. The dynamic interplay between the fluctuations in Bitcoin’s price, the evolving mining ecosystem, and macroeconomic influences will critically define the future of cryptocurrency. Christopher Bendiksen, Head of Research at CoinShares, argues that Bitcoin’s hash rate is fundamentally connected to its price movements. He notes that although Bitcoin’s price can surge, the incremental increase in hash rate is delayed due to the time required for miners to acquire and set up new equipment. When prices are high, the potential rewards entice miners to upgrade their technology, yet the associated operational costs, primarily incurred in local currencies, necessitate a profitable price to justify expansion.

The article discusses recent developments in Bitcoin’s hash rate and price dynamics, presenting a scenario where the network’s processing power has skyrocketed to a record high, indicating increased security and resistance to attacks. However, despite this positive trend in hash rate, Bitcoin’s market price faces downward pressures, influenced by macroeconomic factors and market volatility. The analysis also highlights the challenges faced by miners in maintaining profitability within this environment, particularly as large mining firms gain a significant foothold in the industry.

In conclusion, while Bitcoin’s hash rate has reached unprecedented heights, indicating robust network strength, the cryptocurrency faces notable challenges with declining prices and increasing operational costs for miners. The ongoing dynamics between Bitcoin’s price and hash rate, influenced by broader economic conditions, will be crucial for stakeholders in navigating the complexities of the cryptocurrency market moving forward.

Original Source: bravenewcoin.com

Post Comment