Record Highs in Bitcoin Open Interest Amid Price Surge to $71K

Bitcoin’s recent ascension to $71,000 has coincided with a record high in Bitcoin futures open interest, particularly on the CME, which reported an increase of over 20,000 BTC. U.S. listed spot ETFs have seen a massive influx of $2.7 billion since mid-October. The convergence of high open interest and rising prices signifies growing investor confidence, while funding rates in perpetual market contracts have also surged.

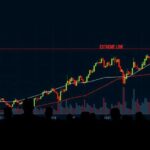

As Bitcoin (BTC) reached unprecedented heights of $71,000, the open interest (OI) for Bitcoin futures witnessed a significant surge, particularly on the Chicago Mercantile Exchange (CME). This surge in open interest, which saw an increase of over 20,000 BTC, marked the highest one-day jump since June 3. Notably, the total open interest exceeded 600,000 BTC, translating to a value of approximately $42.6 billion. This represents growing investor engagement in Bitcoin derivatives, suggesting a robust influx of new capital into the market. Since October 16, the U.S. listed spot Exchange-Traded Funds (ETFs) have experienced net inflows amounting to $2.7 billion, underscoring the growing institutional interest in Bitcoin. The CME reported that contracts saw a notable increase of 9% within a 24-hour period, contributing to its dominance in the futures market with an open interest of 171,700 BTC, valued at over $12.22 billion. As traders express confidence in Bitcoin’s trajectory, the funding rates in perpetual futures markets have also spiked to 15%, indicative of a bullish sentiment among traders. This surge in funding rates coupled with record open interest and substantial ETF inflows signifies a shift from earlier hedging strategies to more bullish trading positions. Moreover, market analysts observe a divergence between the trends in ETF inflows and CME open interest, reflecting a transition toward directional long investments, as evidenced by recent institutional purchases such as that from Emory University’s endowment. In contrast, some analysts, such as Andre Dragosch from Bitwise, note an increase in net short positioning, suggesting the re-emergence of cash-and-carry trades, which could mitigate the implication of purely bullish sentiment in the market. This complexity emphasizes the need for ongoing scrutiny of market dynamics and investor strategies amid Bitcoin’s volatility.

The recent surge in Bitcoin’s price and open interest in futures contracts can be attributed to several interconnected factors. Record high inflows into U.S. listed spot ETFs are revitalizing institutional interest, alongside the growing volume of open interest in CME Bitcoin futures. Open interest is a crucial metric as it indicates the total number of contracts that are currently outstanding and not yet settled. A high open interest signifies substantial market activity and interest, particularly when it aligns with rising prices, suggesting that new investors are entering the market. Understanding these trends helps elucidate the evolving strategies of institutional investors and the overall sentiment in the cryptocurrency ecosystem.

In summary, the considerable increase in Bitcoin’s open interest and price can largely be traced back to record inflows into U.S. listed spot ETFs, a rise in bullish trader sentiment as evidenced by significant funding rate increases, and notable activity on the CME. The conflicting perspectives on market positioning point to a complex and dynamic trading landscape, warranting further observation as these trends continue to unfold in the context of Bitcoin’s price volatility.

Original Source: www.coindesk.com

Post Comment