Bitcoin Price Approaches Major Parabolic Rally Amidst Whale Investments

Bitcoin (BTC) is poised for a major price rally, potentially exceeding $74,000, driven by increased demand from whale investors and U.S. spot ETF issuers. The price recently surged beyond $70,000 and approached its all-time high of $73,737. Significant institutional inflows, alongside favorable market conditions ahead of the 2024 elections and expected interest rate cuts, contribute to a bullish outlook for Bitcoin.

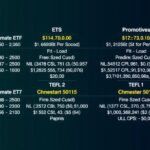

The Bitcoin (BTC) market is on the verge of a significant parabolic rally, potentially surpassing $74,000, largely driven by substantial investments from whale investors and increased demand linked to upcoming economic events. Recently, the price of Bitcoin surged past $70,000, almost reaching its historical peak of approximately $73,737 achieved in March 2024. The current market dynamics suggest that Bitcoin holders are realizing considerable profits, as about 99 percent of previous buyers are in the black with their investments. The rush in the Bitcoin market is also reflected in its dominance over altcoins, with BTC now holding about 60 percent of the market share. Investor sentiment appears to be buoyant, evidenced by a surge in the fear and greed index to 77 percent, indicating extreme greed—an omen of a potential bullish market. Analyst Ali Martinez has indicated that the Bitcoin market may be entering a parabolic phase, supported by technical indicators such as the MVRV ratio experiencing a bullish cross, historically associated with significant price surges. For Bitcoin to maintain its momentum and validate an upward trajectory towards a new all-time high, it is crucial for it to consistently close above its resistance level of approximately $73,737. Should it succeed, the next target could lie within a liquidity range of $84,000 to $94,000. Conversely, a decline below $70,000 could lead to support levels between $66,000 and $68,000 before a potential rebound. The current price dynamics are heavily influenced by whales and institutional investments, particularly from the U.S. spot Bitcoin ETF issuers, who have collectively invested nearly $1 billion in BTC recently. This influx of funds has coincided with high market speculation similar to patterns observed with Gold, reinforcing Bitcoin’s position in the investment community. On Tuesday, the net cash inflow recorded by these ETF issuers was over $870 million, which underscores a growing institutional interest. As the political landscape shifts with pro-crypto candidates gaining traction, alongside anticipated financial adjustments from the Federal Reserve, the outlook for Bitcoin remains optimistic.

The current Bitcoin price surge is attributed to significant contributions from institutional investors, particularly those involved with U.S. spot Bitcoin ETF issuers. The demand for Bitcoin has been intensifying, especially with the upcoming 2024 U.S. elections and expected monetary policy changes from the Federal Reserve. Bitcoin’s price movements reflect broader trends in the cryptocurrency market, including its interactions with altcoins and the overall perception of risk and reward within investment portfolios. The fluctuation of Bitcoin’s dominance in the market reveals shifting investor sentiment and speculative behaviors, providing insights into future market directions.

In conclusion, Bitcoin is positioned for a potentially explosive rally, buoyed by strong institutional demand and favorable market sentiment. Continued investment from whale investors, particularly through U.S. spot Bitcoin ETFs, signals robust market confidence, with a strong possibility of reaching new all-time highs if current trends persist. However, vigilance remains essential as market volatility could lead to retracements that impact long-term bullish outlooks. Stakeholders should remain informed and analytical as they navigate the evolving landscape of cryptocurrency investments.

Original Source: www.coinspeaker.com

Post Comment