Bitcoin Price Surges Past $97,000 with Expectation of Continued Growth

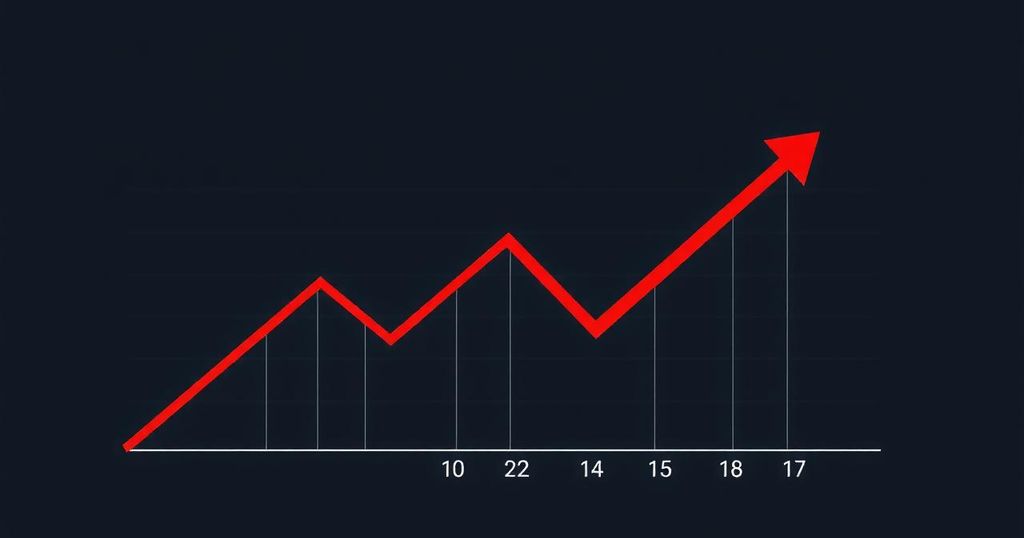

Bitcoin has recently surpassed $97,000, demonstrating significant upward momentum as traders eye a six-figure valuation. Influenced by market volatility and political dynamics, the cryptocurrency has managed to withstand extensive liquidations among short sellers. Analysts predict that Bitcoin may exceed $100,000 by the end of the year, with no signs of market overheating noted.

Bitcoin continues to surge, recently exceeding $97,000 as traders anticipate that the cryptocurrency may reach a six-figure valuation by the end of the year. This remarkable rise marks a significant milestone, occurring within a short time frame that saw Bitcoin breach its previous high of $95,000 according to CoinGecko data. The market’s volatility has resulted in a significant $100 million in liquidations over a 24-hour period, predominantly among short sellers who had anticipated a decline in price.

This year has seen increased volatility, largely attributed to the recent introduction of several spot exchange-traded funds in the United States and an uptick in options trading linked to those ETFs. The optimism surrounding the U.S. presidential election and potential shifts in regulatory frameworks under a Republican administration have also contributed to positive sentiment within both crypto and stock markets.

Among the notable market reactions was the Nasdaq achieving a record high above 21,182 points, alongside the S&P 500 surpassing 6,000 for the first time. Contributing factors to this surge include expectations of Federal Reserve rate adjustments, robust corporate earnings primarily driven by the tech sector, and advancements in artificial intelligence that have buoyed investor confidence.

Analysts project that Bitcoin may exceed the anticipated $100,000 mark by December, with Bernstein Research postulating that the cryptocurrency could potentially double to $200,000 by the end of 2025. Pavel Hundal, the lead analyst at Swyftx, remarked on the rational nature of current market trends and emphasized that there are no signs of overheating in the futures market. He noted, “There’s zero sign of any overheating in the futures market.” Hundal further elucidated that Bitcoin’s funding rate for perpetual contracts indicates stability, seated at approximately 10%, a stark contrast to the significant 107% APR recorded for Bitcoin longs in March.

As traders and analysts closely monitor market movements, the coming hours may provide clarity on whether Bitcoin’s ongoing rise will culminate in achieving the $100,000 landmark.

The current surge in Bitcoin’s price is a key theme in financial discussions, stemming from a combination of significant market activities and external factors such as political shifts. The introduction of spot exchange-traded funds in the U.S., which legitimizes and enhances the accessibility of crypto investments, has energized trading dynamics. The broader financial landscape, buoyed by anticipated regulatory changes and favorable economic conditions, has further invigorated investor sentiment. Additionally, historical comparisons of funding rates offer insights into market stability and potential overexertions that could indicate a bubble.

In summary, Bitcoin’s recent price surge to over $97,000 reflects mounting optimism among traders and is indicative of broader trends within the cryptocurrency market. With substantial liquidations and the favorable market climate driven by political and economic factors, analysts remain optimistic about Bitcoin’s future trajectory. The lack of overheating in the futures market supports this outlook, leaving open the prospect for Bitcoin to approach or exceed the significant milestone of $100,000 in the near future.

Original Source: decrypt.co

Post Comment