Bitcoin’s Price Rally Remains Strong Amid Whale Accumulation and Tether Liquidity

Bitcoin’s price rally is invigorated by large whale acquisitions of 20,000 BTC worth $2 billion, a solid support level at $96,870, and an influx of $19 billion in new USDT liquidity by Tether, leading to a healthier market performance and the potential for new all-time highs.

Bitcoin is witnessing an encouraging upward trend, primarily due to significant accumulation by large investors and increased liquidity from stablecoin issuers. Recent data illustrates that Bitcoin whales have acquired 20,000 BTC valued at approximately $2 billion, contributing to a notable price increase. Furthermore, a strong support level exists at $96,870, with approximately 1.45 million addresses holding around 1.42 million BTC, indicating robust demand at this price point.

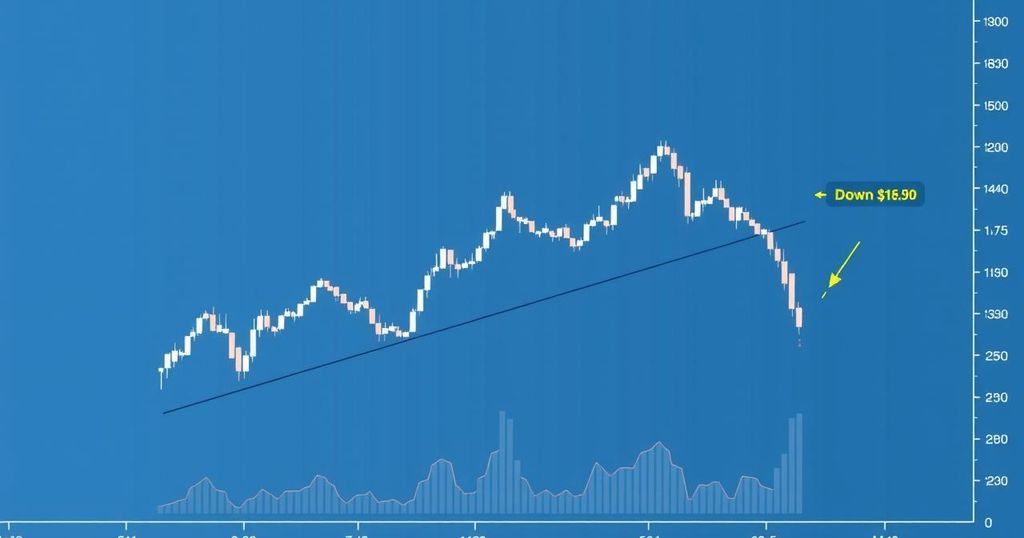

As of the latest reporting, Bitcoin trades at around $99,376, reflecting a gain of 2.17% with a market capitalization nearing $1.97 trillion. Despite a 33% decline in daily trading volumes totaling $84 billion, the on-chain indicators emphasize continued whale accumulation, suggesting a sustained bullish sentiment.

Ali Martinez, a reputable crypto analyst, emphasizes that local price peaks for Bitcoin typically align with significant resistance levels. Currently, this level stands at approximately $112,926, presenting a potential challenge for future increases. The support level at $96,870, combined with strong whale activity, reinforces expectations for further price ascension.

Additionally, Bitcoin exchange-traded funds (ETFs) continue to witness solid inflows, with total holdings surpassing those of Satoshi Nakamoto. Recent data indicates that inflows reached $376 million, with substantial contributions from BlackRock’s IBIT. The rapid growth of these funds demonstrates heightened institutional backing for Bitcoin.

The enhancement in Bitcoin’s liquidity is also attributed to Tether, which has minted an added $2 billion in USDT, culminating in a total of $19 billion minted since November 6. This influx of stablecoin liquidity consistently provides upward momentum for Bitcoin prices. Furthermore, Tether’s introduction of the Wallet Development Kit aims to broaden its presence in the cryptocurrency market.

The cryptocurrency market is inherently volatile, influenced by large-scale investor activities and liquidity dynamics. Bitcoin’s price fluctuations are often accompanied by movements in stablecoin liquidity, specifically USDT issued by Tether. Understanding the relationship between whale accumulation, support levels, and institutional investments is crucial for anticipating price direction in Bitcoin and, by extension, the broader market. In recent weeks, Tether has significantly increased its USDT supply, providing ample liquidity that often correlates with Bitcoin price movements. Moreover, the cryptocurrency’s resilience in maintaining key support levels indicates potential for future growth, despite transient market corrections.

In summary, the current landscape suggests that the Bitcoin price rally is likely to continue, bolstered by significant whale accumulation, strong support levels, and enhanced liquidity from Tether. As institutional interest through Bitcoin ETFs persists and fresh USDT is introduced into the market, these factors converge to present a promising outlook for Bitcoin’s price performance in the immediate future. It remains imperative for investors to monitor key resistance levels and continued accumulation trends as the market evolves.

Original Source: coingape.com

Post Comment