Bitcoin Price Faces Resistance at $102,000 Amid Market Correction

Bitcoin is currently facing challenges in breaking through the $102,000 resistance level, with potential support at $97,500. Although it has shown some upward movement above $98,800, bearish trends and technical indicators suggest caution. Traders should monitor key resistance and support levels closely as the market evolves.

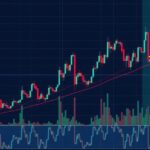

Bitcoin has encountered significant resistance just above the $100,000 mark, struggling to break through the $102,000 level. Currently, it is correcting recent gains and is poised to test the crucial support at $97,500. Having formed a base above $98,800, Bitcoin briefly surpassed the $100,000 threshold but remains below the $102,000 zone due to bearish pressure. The current trading price hovers above $98,000 and the 100 hourly Simple Moving Average, indicating that while there is potential for an upward movement, immediate resistance levels at $100,500 and $101,500 may inhibit progress.

Should Bitcoin maintain stability above $97,500, it could initiate a fresh bullish trend. Conversely, a failure to breach the $102,000 resistance could lead to further declines with immediate downside support around $98,400 and potentially down to $95,000 if selling pressure intensifies. In technical terms, both the Hourly MACD and RSI suggest a bearish trend, indicating caution for investors as they navigate this fluctuating market environment.

The current analysis of Bitcoin’s price performance reflects the ongoing challenges it faces in achieving and maintaining traction in a highly volatile market. Resistance at the $102,000 level has proven formidable, impacting traders’ confidence in a sustained rally. Technical indicators such as the MACD and RSI provide insights into the market’s sentiment, further illustrating the broader concerns regarding potential downturns as the cryptocurrency establishes its next course. Understanding these dynamics is crucial for investors making strategic decisions in this evolving landscape of digital finance.

In conclusion, Bitcoin’s inability to surpass the $102,000 resistance illustrates the challenges faced in sustaining a rally. With critical support levels at $97,500 and $98,400, the cryptocurrency remains at a crossroads where strategic decision-making is essential. As market conditions fluctuate, investors must remain vigilant and well-informed to navigate potential losses or gains based on prevailing trends and indicators.

Original Source: www.newsbtc.com

Post Comment