Bitcoin Price Continues to Adjust after Record Highs, Key Support Remains

Bitcoin has recently achieved a new all-time high above $108,000 but is currently undergoing corrections. Trading above $105,000, it maintains some bullish momentum while also facing key support at $103,750. Investors should monitor resistance levels closely, as a failure to surpass them may lead to further declines in price.

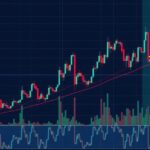

The price of Bitcoin has undergone a recent increase, breaching the $106,000 resistance and reaching a new all-time high of over $108,000. However, it is now in a corrective phase. Despite these fluctuations, Bitcoin continues to trade above $105,000, maintaining momentum above the 100 hourly Simple Moving Average. A crucial trend line has been compromised, which could impact future price movements, but if Bitcoin can hold above the $103,750 support zone, there remains a potential for further increases.

Following the formation of a new base, Bitcoin’s price surged past the $104,000 and $105,000 thresholds. Subsequently, it has retraced slightly below the 23.6% Fibonacci retracement level from the recent low to the new high. Resistance levels of significance for Bitcoin include $106,200 and $107,750, with a potential upward trajectory if these levels are surpassed. Conversely, failure to break above these levels may lead to additional downside risks, with key support zones at $105,000 and possibly $103,750 and $102,200 in the event of more substantial declines.

Bitcoin has demonstrated remarkable volatility, consistently challenging its previous price thresholds. As it approaches new heights, the market’s response includes periods of both gains and corrections. Understanding the support and resistance levels is essential for anticipating future market movements. Technical indicators such as the MACD and RSI provide insight into market sentiment, vital for traders seeking short-term opportunities in this fluctuating landscape. Influential market analysts like Aayush Jindal offer valuable perspectives based on years of experience in cryptocurrency and forex trading, illustrating the blend of technical acumen and market intuition required to navigate such a dynamic environment.

In conclusion, while Bitcoin’s price has reached significant highs above $108,000, its current corrective phase prompts close monitoring of key support levels, particularly around $105,000 and $103,750. The potential for continued upward movement exists, contingent on the ability to surpass resistance levels like $106,200. Future trends will be closely tied to market responses surrounding these technical indicators, aligning with the insights provided by seasoned analysts. Investors are encouraged to remain vigilant and conduct thorough analyses before making decisions in this volatile segment of the financial market.

Original Source: www.newsbtc.com

Post Comment