Bitcoin’s Correction Phase: Key Levels and Future Rally Prospects

Bitcoin’s price has corrected to $100,544 after peaking at $108,277, aligning with the Elliott Wave analysis. Analysts emphasize critical support levels at $98,000 and $85,000, potentially leading to a rally between $120,000 and $135,000. Carefully monitoring these levels is essential for traders to position themselves for upcoming opportunities amid ongoing market volatility.

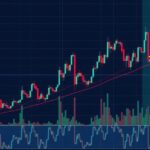

Bitcoin’s market has exhibited significant volatility, dropping 7 percent to $100,544 after reaching a peak of $108,277, thus entering a correction phase. This decline aligns with the Elliott Wave analysis, suggesting that the price may temporarily retrace before a potential rally towards $120,000 to $135,000. Analysts are noting essential support levels, particularly at $98,000 and $85,000, as critical zones to watch during this correction phase.

Experts highlight that Bitcoin’s primary support level at $98,000 may play a vital role in price stabilization. Additionally, a secondary support range between $96,000 and $98,000 offers traders alternative levels to observe for potential recovery indicators. Utilizing Fibonacci retracement levels reveals $90,048 at the 0.382 retracement, $85,063 at the 0.5 retracement, and $80,354 at the 0.618 retracement, suggesting these levels could mark critical points for concluding the current price correction.

Looking ahead, the next wave, termed Wave 5, is anticipated to drive Bitcoin towards new highs between $120,000 and $135,000, indicating a robust upward momentum generated from the current correction. Traders with short positions near $106,000 to $108,000 are already experiencing gains, while long-term investors are monitoring the situation for stabilization opportunities. This upcoming wave is poised to potentially become one of the largest rallies of the current cycle, emphasizing the importance of tactical entry strategies.

As the ongoing correction unfolds, traders are presented with an ideal window to strategically position themselves for Bitcoin’s forthcoming major upward movement. Analysts advise concentrating on the $85,000 to $80,000 range to detect signs of stabilization before making new investments. Patience is a crucial virtue during this period, as hasty entries could incur significant risks. By carefully tracking the pertinent support and retracement levels, traders can align their trading strategies to capitalize on the anticipated momentum in Bitcoin’s value.

The current phase in Bitcoin’s trading trajectory reveals significant fluctuations as the cryptocurrency has retraced from a recent high, entering a correction phase. This decline has sparked discussions among traders and analysts, highlighting the relevance of support levels and Fibonacci retracement zones. The application of Elliott Wave theory further enriches the analysis, suggesting that following this correction, a substantial rally may ensue, positioning Bitcoin for possible new heights in the upcoming trading cycles.

In conclusion, Bitcoin’s recent price correction is characterized by particular support levels, including $98,000 and $85,000, which are crucial for gauging potential recovery signs. As the market anticipates a rally between $120,000 and $135,000 in the forthcoming Wave 5, the strategic observation of these levels is essential for traders. Patience and careful entry strategies will be paramount to seize the forthcoming market opportunities while mitigating risks.

Original Source: www.binance.com

Post Comment