Cryptocurrency Market Decline Following Federal Reserve Rate Cut

The US Federal Reserve cut interest rates by 0.25% to 4.5%, triggering panic selling in both the stock and crypto markets. Bitcoin declined by 5.85%, with altcoins like Ethereum and XRP experiencing even greater losses. Fed Chairman Jerome Powell’s comments suggested a cautious stance on future rate cuts, contributing to market volatility.

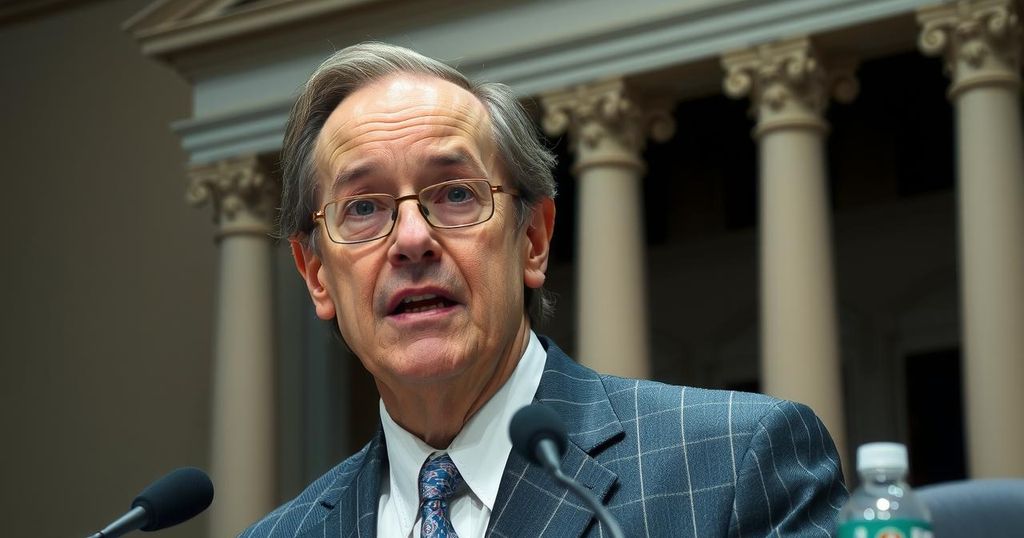

On December 18, 2024, the United States Federal Reserve announced a reduction in interest rates by 0.25%, lowering the rate to 4.5%. This decision initiated panic selling in both the stock market and the cryptocurrency sector, leading to substantial declines in market valuations. Bitcoin experienced a significant drop of 5.85%, with many altcoins suffering even larger losses, highlighting the interconnectedness of these financial markets. During a press conference, Fed Chairman Jerome Powell articulated the goals behind the rate cut, emphasizing a commitment to economic stability amid evolving conditions.

The Federal Reserve’s decision to cut interest rates is primarily aimed at fostering economic growth and controlling inflation. As inflation has fluctuated significantly throughout the year, with a yearly peak of 3.5% in March and a subsequent decline to 2.4% in September, the Fed’s approach is cautious and data-driven. This latest rate cut marks the third major adjustment of the year, reflecting an attempt to balance the economic landscape while considering future rate changes dependent upon economic indicators.

The Fed’s recent rate cut and the subsequent panic selling underscore the volatility of financial markets, particularly in reaction to monetary policy adjustments. As Bitcoin and other cryptocurrencies face heightened selling pressure, the broader implications for the market’s stability remain uncertain. Investors should remain vigilant, as the ongoing volatility reflects not only immediate market reactions but also larger economic trends that could influence future investment strategies.

Original Source: coinpedia.org

Post Comment