Bitcoin Price Prediction: BTC Could Surge to $168K Amid Market Indicators

The Mayer Multiple indicates that Bitcoin (BTC) may be poised for an upswing, targeting $168,000, despite trading at $95,646 currently. Increased buying from Korean investors contrasts with reduced activity from U.S. investors, shaping the market’s trajectory. Analyst predictions and institutional interest bolster a potentially bullish future for Bitcoin.

The Mayer Multiple, a noteworthy price indicator in the cryptocurrency realm, suggests that Bitcoin (BTC) possesses considerable potential for upward movement, potentially reaching $168,000. As of now, Bitcoin is trading at $95,646, experiencing a minor decline of 7.89% from its recent peak. Despite this, the overall market sentiment appears bullish, with notable buying activity reported among Korean investors which may support BTC’s price in the future.

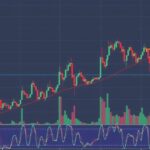

Analyst Ali Charts posits that the recent price correction is part of a broader bullish market structure that could propel Bitcoin toward the targeted peak of $168,000. The Mayer Multiple evaluates market conditions using BTC’s current price in relation to its 200-day moving average, currently standing at an MM of 1.3—indicative of a fair valuation. However, should market conditions prevail, there is potential for Bitcoin to escalate to its upper limit around an MM of 2.4, approximating $168,494, indicating overvaluation.

Further supporting this bullish sentiment, institutional and large-scale investors have increased their stake in Bitcoin, rising from 14% to 31% of Bitcoin’s Known Entities Cap Table. This momentum is complemented by a surge in purchasing activity from Korean investors, whose recent engagement has resulted in a drastic uptick in the Korean Premium Index.

In contrast, U.S. investors exhibit a reduction in buying enthusiasm, as evidenced by the decline in both the Coinbase Premium Index and the Fund Market Premium Index. This presents a dual scenario where Korean investors potentially drive Bitcoin’s price upward while U.S. sentiment lingers in a cooling phase. The returning interest from U.S. investors could invigorate the market further, reinforcing Bitcoin’s trajectory towards the $100,000 mark.

Bitcoin, the leading cryptocurrency, has attracted significant attention as both a speculative asset and a store of value. The Mayer Multiple is one of many tools utilized by investors to assess Bitcoin’s price potential against its historical patterns. Given Bitcoin’s volatile nature, indicators like the Mayer Multiple help investors make informed predictions regarding market trends and price movements, specifically identifying potential highs and lows based on relative valuations to long-term averages.

In summary, the analysis draws attention to the dynamic interplay of various investor groups in the market. While Bitcoin is currently consolidating at around $95,646, the bullish outlook driven by the Mayer Multiple and significant purchasing activities, particularly from Korean investors, suggests a potential rally towards $168,000. Conversely, the subdued participation from U.S. investors highlights the market’s dichotomy, where overall demand could surge should this group return to buying.

Original Source: ambcrypto.com

Post Comment