Bitcoin’s Recent Price Dynamics: Analyzing Support and Resistance Levels

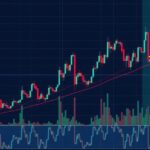

Bitcoin’s price has declined below $96,500 after failing to maintain gains above $100,000. The asset is currently testing the $95,000 support level, with potential declines towards $93,200 if the resistance at $96,500 is not breached. Technical indicators suggest a bearish trend, raising concerns for future price movements as the market continues to assess Bitcoin’s stability in a volatile trading environment.

Bitcoin has experienced significant fluctuations recently, unable to sustain its position above $100,000, subsequently returning below the $96,500 threshold. Initial resistance was noted at $99,400, from where a downward trend commenced, violating the critical supports at $98,400 and $96,500. The current trading status is precarious, hovering around the $95,000 support area, with potential further declines to the $93,200 support zone if upward momentum fails to materialize. Conversely, a resurgence above the $96,500 resistance could potentially drive the price toward $99,000 and ultimately $100,000, contingent on clearer bullish indicators.

Technical analysis illustrates that the hourly MACD indicates strengthening bearish momentum, while the RSI remains below the neutral threshold of 50, suggesting increased selling pressure. If Bitcoin cannot breach the immediate resistance levels, it may continue to consolidate around the current levels or experience lower support pressures, with the next significant supports identified at $95,000 and $93,800. The balance of momentum remains delicate, with any definitive price movement anticipated in the near term.

The cryptocurrency market, specifically Bitcoin’s price movements, has become an area of heightened scrutiny and interest among investors. Bitcoinalized in recent weeks, with various resistance and support thresholds being established around critical price points, notably at $100,000. Understanding the technical movements, retracement levels, and the implications of these fluctuations allows stakeholders to grasp the market sentiment and make informed decisions. Analysts forecast Bitcoin’s trajectory through observed patterns, emphasizing the significance of price action on both micro and macro levels within the volatile cryptocurrency space. The ongoing battle between bullish and bearish forces illustrates the complex interplay of market factors influencing Bitcoin’s price, necessitating a thorough, analytical approach to investment in this asset class. Additionally, Aayush Jindal, a seasoned expert in financial analysis, continues to provide insights based on technical fundamentals, guiding seasoned and novice traders alike in navigating these tumultuous waters.

In summary, Bitcoin’s recent price fluctuation highlights the ongoing volatility and the critical resistance and support levels that traders must heed. As it stands, Bitcoin remains vulnerable to further declines if upward momentum does not regain strength against established resistance levels. Technical indicators such as the MACD and RSI provide vital insights into market sentiment, suggesting that close monitoring of these metrics is essential for investors. Aayush Jindal’s comprehensive approach to financial markets remains an asset for those looking to understand and capitalize on Bitcoin’s dynamic nature.

Original Source: www.newsbtc.com

Post Comment