Bitcoin Price Recovery: Can the Bulls Surmount Key Resistance?

Bitcoin is recovering from recent losses, currently trading above $92,500. The price movement indicates bullish potential, contingent upon overcoming the $96,000 resistance level. Essential support is identified at $94,000 and $93,500. Technical indicators reflect bullish trends, but caution is advised in the presence of market volatility.

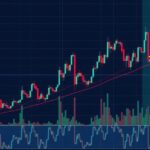

Bitcoin is demonstrating signs of recovery, having moved past the $91,400 resistance level, and is now trading above $92,500 while maintaining a position above the 100-hourly Simple Moving Average. A bullish trend line is forming with support situated at $94,000, indicating potential for further gains. If Bitcoin manages to sustain prices above $93,500, it could initiate another upward trajectory. Recently, Bitcoin overcame crucial resistance levels, enabling it to trade above $93,200 and $93,500, confirming an upward movement that indicates optimism in the market.

Immediate resistance is positioned near $95,250, correlating with the 76.4% Fibonacci retracement of a decline from a high of $96,040 to a low of $92,588. The foremost major resistance level is at $96,000, and surpassing this could propel Bitcoin further, potentially reaching $97,500 or even testing $98,800. Conversely, should Bitcoin fail to breach the $96,000 mark, it could undergo a fresh decline, with immediate support levels established at $94,000 and $93,500. Further losses could see Bitcoin dip towards the $92,550 range or lower, down to $91,200.

Supporting this analysis, technical indicators such as the MACD and RSI suggest a bullish momentum as both indicators signal strengthening in the market.

In conclusion, the price dynamics surrounding Bitcoin reflect a precarious balance between potential for recovery and the risk of decline, hinging on the inability to surpass critical resistance levels while maintaining necessary support. Investors should remain vigilant as these fluctuations underline the importance of clear market signals and technical indicators in navigating cryptocurrency investments.

In recent market conditions, Bitcoin has experienced significant volatility, showcasing a recovery phase after trading as low as $91,400. The current market structure indicates a potential upward trend, with key resistance and support levels critically shaping investor sentiment. The areas surrounding $94,000, $96,000, and $97,500 are pivotal as Bitcoin seeks to gain momentum and can reveal underlying market strength or weakness, guiding investment strategy.

The potential for Bitcoin to ascend above the $96,000 resistance level remains a focal point for traders. With signs pointing toward a recovery, maintaining support above $93,500 is essential for sustained upward movement. However, should the price fail to exceed critical resistance, a decline could ensue, highlighting the volatility and risks intrinsic to cryptocurrency trading. Continuous observation of technical indicators and market trends is essential for making informed investment decisions.

Original Source: www.newsbtc.com

Post Comment