Bitcoin Approaches $100,000 Amidst Significant Exchange Withdrawals and Market Insights

Bitcoin is nearing $100,000 after experiencing minor price volatility and significant withdrawals from exchanges. Over 48,000 Bitcoins have been withdrawn in a week, indicating growing investor confidence. On-chain indicators suggest a robust accumulation phase, while caution persists among analysts regarding market dynamics and potential hindrances to immediate bullish recovery.

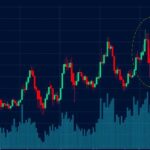

On Sunday, Bitcoin (BTC) exhibited minor price fluctuations after a stable weekend, trading at approximately $98,165, reflecting only a slight 0.08% rise over the previous day. An encouraging 3% weekly recovery came after a dip to $91,547 at the end of December, correlating with on-chain data revealing over $42 billion in Bitcoin profits realized throughout the month. Recently, however, a notable increase in whale activity has been observed, with more than 48,000 Bitcoins, valued at around $4.5 billion, withdrawn from exchanges in the past week, according to analyst Ali Martinez.

This trend is supported by insights from CryptoQuant analyst Alex Adler, who noted that Bitcoin deposits to exchanges have plummeted to their lowest levels since 2016. This shift indicates that investors are increasingly opting to store their Bitcoin in personal wallets rather than on exchanges. The consistent outflow of Bitcoins from exchanges, as confirmed by the Netflow-to-Reserve Ratio, points to a significant accumulation phase, creating the potential for notable price advancements in the near term.

Market analysts, including Avocado Onchain, attribute the recent price pullback and slow recovery to Bitcoin’s “cooling-off period” within a broader bullish cycle. Of significance is the observation that after Bitcoin surpassed $108,000, a correction ensued. Avocado highlights that key on-chain indicators, such as the Adjusted Spent Output Profit Ratio (SOPR) and Miner Position Index (MPI), suggest enduring market resilience, despite SOPR’s downward trend indicating reduced profits, where historically, a drop below 1 tends to stimulate a rebound.

Moreover, the behavior of miners reflects a positive sentiment towards Bitcoin, as the MPI demonstrates that miners are choosing to retain their holdings rather than sell them on exchanges. Furthermore, decreasing network fees and funding rates are indicative of a cooling phase rather than a market peak. However, caution remains among some analysts; “Darkfost,” a CryptoQuant analyst, pointed out a potential supply shift between long-term holders and short-term holders. He suggests that while demand from short-term holders has been pivotal in supporting Bitcoin’s price, the declining short-term holder Spent Output Profit Ratio may inhibit immediate bullish recovery.

Bitcoin, the leading cryptocurrency, continuously garners considerable attention from investors and analysts due to its price volatility and market dynamics. Market fluctuations and large withdrawals from exchanges have often been indicative of investor sentiment and potential price movements. With recent trends suggesting a significant accumulation phase, this moment is critical in determining Bitcoin’s trajectory as it nears the coveted $100,000 mark. On-chain analytics provide essential insights into trading behaviors and help decipher market trends, which are crucial in understanding the underlying factors influencing Bitcoin’s price at this moment.

In summary, Bitcoin’s recent performance showcases its remarkable volatility and potential for recovery as it nears a significant price milestone. The substantial withdrawals from exchanges by major investors, alongside a decrease in daily deposits, reflect a strong accumulation phase. However, while market indicators suggest resilience, caution remains vital as some analysts warn of trends that could impact short-term price movements. Moving forward, the interplay between long and short-term holders will be pivotal in shaping Bitcoin’s market behavior.

Original Source: zycrypto.com

Post Comment