Bitcoin Declines Below $98,000 as Treasury Yields Raise Market Concerns

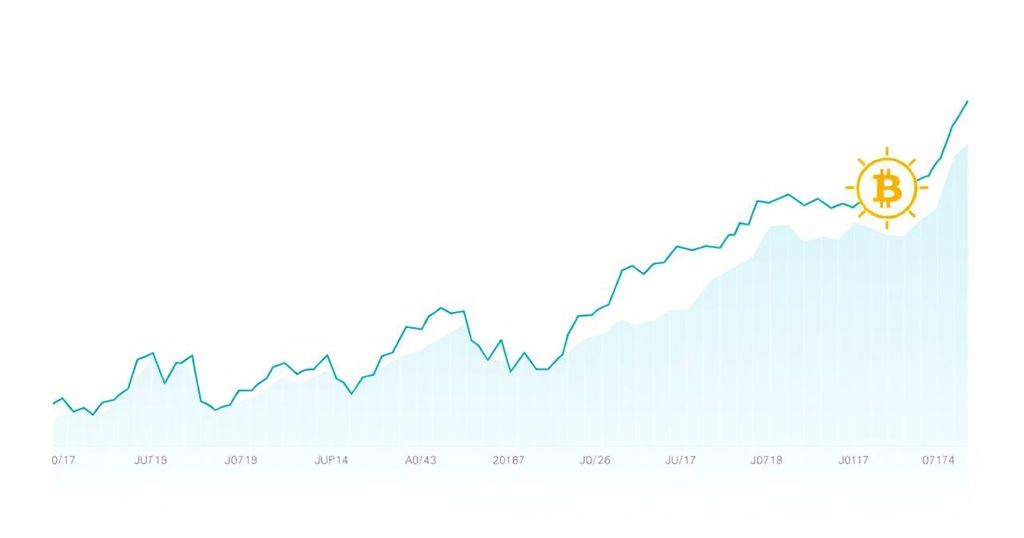

Bitcoin fell 4.8% to $97,183.80 amid rising Treasury yields, impacting risk assets. Major crypto stocks also declined, with uncertainty surrounding Federal Reserve rate cuts adding to market volatility. Despite potential growth, the immediate outlook is challenged, reflecting 120% gains in 2024 thus far.

On Tuesday, Bitcoin experienced a sharp decline, dropping 4.8% to $97,183.80, according to Coin Metrics. This downturn comes amid rising Treasury yields that broadly affected risk assets, leading the CoinDesk 20 index to fall by over 5%. Shares of major crypto firms, including Coinbase and MicroStrategy, also underperformed, with declines exceeding 7% and 9%, respectively. Additionally, Bitcoin mining companies like Mara Holdings and Core Scientific reported decreases of around 5%.

The price drop followed a sudden spike in the 10-year U.S. Treasury yield, prompted by unexpected growth in the U.S. services sector as reported by the Institute for Supply Management. This growth raised concerns regarding persistent inflation, which historically pressures growth-oriented risk assets such as cryptocurrencies. Bitcoin had been trading above $102,000 the previous day, and many investors project a potential doubling of its value over the year. The anticipated regulatory clarity is hoped to bolster digital asset prices and benefit associated stocks, including Coinbase and Robinhood.

Nonetheless, uncertainty surrounding the Federal Reserve’s future interest rate cuts presents potential obstacles for cryptocurrency valuations. In December, the Fed indicated that, while a third rate cut was forthcoming, fewer cuts may be enacted in 2025 than previously expected. Historically, rate cuts have tended to positively influence Bitcoin prices, whereas increases usually detract from its value. As of 2024, Bitcoin has seen an increase of over 3% and is on track for a significant 120% gain year-to-date.

The performance of Bitcoin and the broader cryptocurrency market is often closely linked to economic indicators and monetary policy decisions. In particular, rising Treasury yields typically signal increased borrowing costs, which can adversely affect risk assets, including cryptocurrencies. This relationship has been particularly scrutinized as investors assess the implications of Federal Reserve interest rate cuts or hikes, which can significantly sway market dynamics. Additionally, market fluctuations often follow new financial data releases, which impact investor sentiment and trading behavior, particularly in volatile sectors like cryptocurrencies.

In summary, Bitcoin’s recent decline to below $98,000 is attributed to a rise in Treasury yields that has put downward pressure on risk assets, including cryptocurrencies. While the long-term outlook remains optimistic with expectations of significant gains in 2024 supported by regulatory clarity, uncertainties regarding Federal Reserve interest rate policy may introduce volatility. Investors remain cautious as they navigate these developments in the market.

Original Source: www.cnbc.com

Post Comment