Bitcoin Price Drops Below $98K Amid Strong U.S. Economic Data Impact

Bitcoin’s price dropped below $98K following strong U.S. economic data, leading to a significant decline in the cryptocurrency market. This downturn liquidated approximately $300 million in long positions and adjusted projections for Federal Reserve rate cuts, contributing to a volatile trading environment.

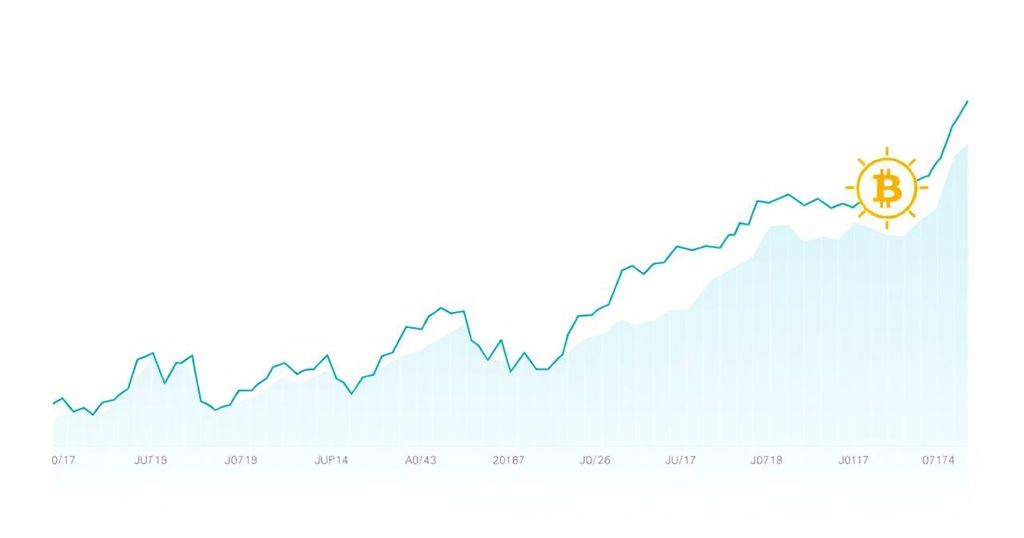

Bitcoin (BTC) experienced a significant decline, falling below the $98,000 mark amid a backdrop of unexpectedly strong U.S. economic indicators. Specifically, data indicating an increase in job openings combined with a robust ISM Services PMI led to heightened investor anxiety, affecting the entire cryptocurrency market. The overall drop saw BTC lose more than 4% of its value, with major altcoins such as Ethereum (ETH) and Solana (SOL) also recording declines between 6% to 9%. This movement resulted in nearly $300 million in long positions being liquidated in derivatives markets, marking a noticeable shift in market sentiment even as earlier hopes for cryptocurrency momentum appeared diminished.

The relationship between economic data releases and market performance is vital for investors. The U.S. Bureau of Labor Statistics reported an unexpected rise in job openings, and the ISM Services PMI surpassed expectations, leading market analysts to adjust their forecasts regarding interest rate cuts by the Federal Reserve. As a direct consequence, investors recalibrated their expectations for interest rate adjustments, influencing both traditional and cryptocurrency markets, notably inciting significant selling pressure across digital assets.

In summary, the recent downturn in Bitcoin’s price and broader crypto market is attributed to unexpectedly positive U.S. economic data, which has resulted in increased bond yields and a reevaluation of potential Federal Reserve rate cuts. The resultant liquidation of leveraged positions highlights the volatility of the cryptocurrency market and the significant impact of macroeconomic indicators on digital asset prices. Investors may need to remain vigilant as the market continues to respond to forthcoming economic data and policy indications from the Federal Reserve.

Original Source: www.coindesk.com

Post Comment