Bitcoin Price Retreats Over 11% Amid Shifting Market Dynamics

Bitcoin has fallen over 11% from its December peak of $108,000, now trading below $98,000 amid market changes influenced by the Federal Reserve and the U.S. dollar’s strength. Support is noted at $95,500-$96,500, with resistance at $98,500. Broader market pressures are affecting other cryptocurrencies like Ethereum and Solana as volatility prospects increase with looming Treasury debt ceiling issues.

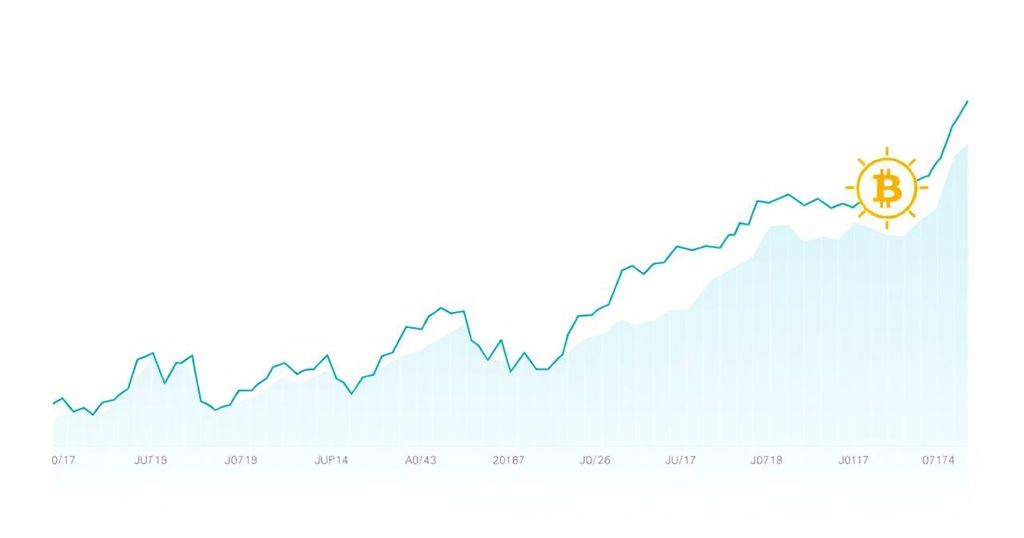

Bitcoin (BTC) has retreated over 11% from its December all-time high of $108,000, currently trading below $98,000. This decline follows a shift in market dynamics influenced by the Federal Reserve’s hawkish monetary policy and the surprising strength of the U.S. dollar. Technical analysis shows that Bitcoin has established support in the range of $95,500 to $96,500, while resistance is noted at $98,500. The cryptocurrency market is seeing similar downturns, with Ethereum and Solana also experiencing price drops.

Market data indicates that selling pressure intensified after Bitcoin was unable to maintain its position above the significant psychological level of $100,000. This breach has altered the previously bullish trend line at $98,500, leading to increased trading volumes as market participants adjust to the new conditions. Recent positive job market data further complicates the situation, influencing both the traditional and cryptocurrency markets.

Broader market trends are impacting Bitcoin’s price, which has touched lows of $96,100, leading to the development of new support levels. Analysts are monitoring these changes closely, as the Moving Average Convergence Divergence (MACD) remains in bearish territory and the Relative Strength Index (RSI) stays below the neutral zone. As a result, some traders have opted to hold significant cash reserves, anticipating market fluctuations.

Furthermore, the looming U.S. Treasury debt ceiling issues could introduce additional volatility that may affect Bitcoin’s price trajectory. A significant focus for investors is whether Bitcoin can reclaim the resistance level of $98,500. A breakthrough here could signal a possible rally to $99,500, contingent upon favorable broader economic shifts.

In conclusion, the cryptocurrency market has entered 2025 under changing circumstances, with Bitcoin’s recent price decline highlighting the ongoing volatility and external influences affecting investor sentiment and trading strategies. Traders continue to navigate these complexities while keeping an eye on key technical indicators and potential regulatory developments.

The cryptocurrency market recently experienced a notable shift as Bitcoin’s price fell significantly from a record high. The Federal Reserve’s measures and the strength of the U.S. dollar have contributed to this downward trend. Various market actors, including stakeholders in Ethereum and Solana, are also feeling the impact. Analysts are closely observing the trading dynamics and macroeconomic indicators, particularly the upcoming U.S. Treasury debt ceiling discussions, which could incite further price volatility.

In summary, Bitcoin’s price decline from its December high underscores a shift in market sentiment influenced by various factors, including economic policies and external market pressures. The establishment of critical support and resistance levels will play a vital role in determining Bitcoin’s future price movements, while broader economic issues such as the U.S. Treasury debt ceiling may introduce additional volatility. As traders adapt their strategies, continuous monitoring of market conditions will be essential for informed decision-making.

Original Source: moneycheck.com

Post Comment