Bitcoin Price Indicates Possible Recovery: Key Levels to Watch

Bitcoin is attempting a recovery after a dip below $90,000, trading above $94,000. Resistance levels are highlighted at $95,200 and $95,800, with major support at $93,200. Recent movements indicate potential upward trends, contingent on breaching key resistance. Technical indicators suggest bullish momentum, but caution is warranted amid market volatility.

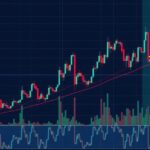

Bitcoin’s price is currently on a recovery trajectory after dipping below $90,000, beginning its ascent from the $89,200 zone. As it trades above $94,000, it aims to overcome resistance near $95,800. A previous breakout above a bearish trendline at $92,000 signifies potential strength in this upward movement.

Following a substantial decline, Bitcoin has seen a revival, notably surpassing the $91,500 and $93,200 thresholds. The price has also breached the 50% Fibonacci retracement of the downward trend that started at $95,808, marking a significant recovery point. However, the challenge remains as resistance from the bearish side persists below $95,500.

Currently, Bitcoin trades above the critical support of $94,000, with a key resistance point at $95,200, leading up to $95,800. Successfully exceeding this resistance could set the stage for further gains, potentially testing $97,400 or reaching the $98,800 mark afterward. Investors must remain cautious, as sustained resistance may trigger a decline back to lower support levels around $90,000.

The technical indicators are showing bullish signs. The hourly MACD is gaining momentum in the bullish zone, while the Relative Strength Index (RSI) for BTC/USD indicates a level above 50. Major support levels stand at $94,000 and $93,200, while the resistance levels are keyed in on $95,200 and $95,800.

Bitcoin has experienced fluctuating prices for years due to various market influences, regulations, and investor sentiment. The cryptocurrency has recently shown an ability to recover from significant dips, and this analysis focuses on the latest price movements indicating a potential recovery phase. By examining support and resistance levels, traders can make informed decisions about entry and exit points, adapting their strategies based on market developments.

In conclusion, Bitcoin is currently recovering from a significant drop, trading above key support levels and aiming to breach resistance points. The upcoming days are critical as movements above $95,800 could pave the way for further gains, while failure to maintain these levels may lead to a decline. Monitoring technical indicators and market trends will be essential for investors looking to navigate these volatile conditions.

Original Source: www.newsbtc.com

Post Comment