Bitcoin Price Faces Bearish Pressure Near Critical $92K Support Level

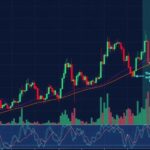

Bitcoin’s price nears critical $92,000 support, with a potential drop to $74,000 if breached. Recent trading sees a 3.5% decline to $95,010 amidst a 156% increase in volume, reflecting bearish sentiment. Technical indicators like MACD and BBP confirm sell pressure, suggesting ongoing market challenges for Bitcoin.

Bitcoin’s price is currently testing a critical support level at $92,000, with indications that a breakdown could lead to a decline towards $74,000, as suggested by MVRV pricing bands. The recent decline of 3.5%, resulting in a price of $95,010, occurs alongside a 156% surge in trading volume, indicating strong selling pressure and bearish sentiment within the market.

The $92,000 level is identified as a significant support zone; if breached, it may trigger further downward movement in Bitcoin’s price. Analyst Ali Martinez emphasizes the importance of this threshold and warns that falling below it could see prices drop to $74,000. The MVRV bands have been effective in signaling market trends, highlighting the increasing bearish pressure in the current price trajectory.

The Moving Average Convergence Divergence (MACD) indicator reflects bearish momentum, with the signal line crossing downwards, confirming growing sell pressure. As the MACD moves below the signal line and the gap widens, it reinforces the sell signal, indicating that market participants should expect continued declines. The MACD histogram further underscores the negative momentum as Bitcoin struggles to stabilize.

Additionally, the Bull Bear Power (BBP) indicator aligns with this bearish trend, revealing substantial negative values that demonstrate bearish control despite any bullish undertakings. The recent drop in Bitcoin’s market value corresponds with rising jitters among investors, compelling heightened selling pressure and aligning with other technical indicators.

As trading volume surged by 156% within 24 hours, reaching $102.04 billion, this influx reflects significant market engagement, predominantly fueled by selling activities. The market capitalization also fell by 3.34% to $1.88 trillion, mirroring the price decline. The negative technical indicators combined with the increased trading volume suggest that Bitcoin currently faces considerable bearish headwinds.

As of now, Bitcoin is trading at approximately $96,360, having experienced a decline of 2.76% over the past 24 hours. Investors are advised to closely monitor the $92,000 support level, as its stability is critical for Bitcoin’s short-term performance.

In conclusion, Bitcoin is at a crucial juncture with a pivotal support level at $92,000. Failure to maintain this level could lead to significant declines, whereas current indicators suggest a strong bearish trend. Observers should remain vigilant of market signals and trends as the situation evolves.

This article discusses the current state of Bitcoin’s market price, specifically focusing on its critical support level of $92,000. Technical analysis tools such as MVRV, MACD, and BBP indicators are utilized to assess market sentiment and predict potential price movements. The volatility and trading volume are analyzed to understand market dynamics, providing insights into the overall bearish trend and potential implications for investors.

The Bitcoin market experiences notable bearish pressure, particularly as it approaches the crucial $92,000 support level. Indicators such as MVRV, MACD, and BBP point to a potentially negative trend, suggesting that prices may decline further if this support is breached. Investors should observe these developments closely to make informed decisions regarding their positions in the market.

Original Source: themarketperiodical.com

Post Comment