Cryptocurrency Price Outlook: Bitcoin, Ethereum, and XRP Analysis for This Week

The cryptocurrency market is facing bearish pressure, with Bitcoin, Ethereum, and XRP showing declining trends. Current market valuations suggest potential for further price corrections as these assets approach pivotal support levels. Investors are urged to exercise caution while evaluating new opportunities in this uncertain landscape.

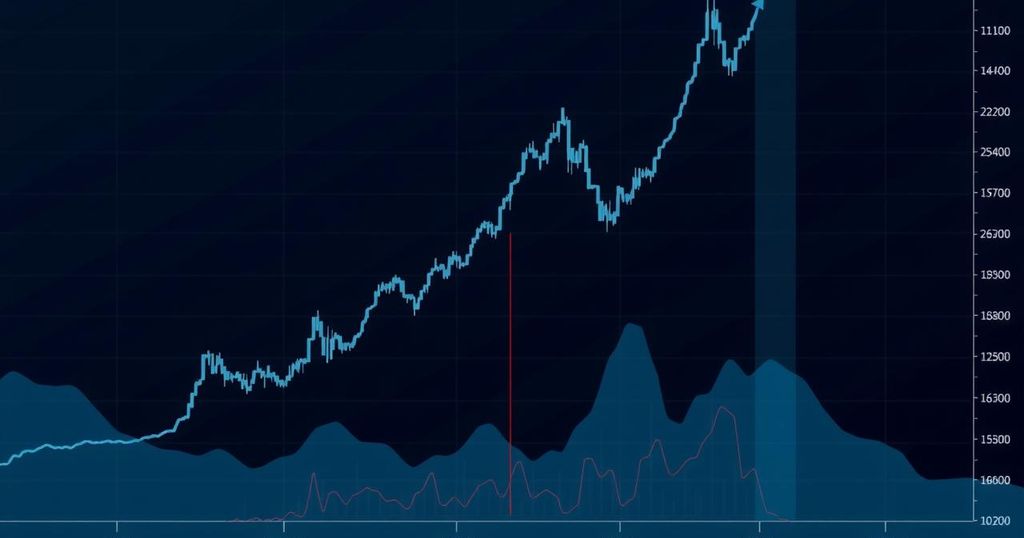

The current crypto market maintains a valuation of approximately $3.15 trillion, reflecting a slight intraday decline of 0.86% and a trading volume reaching $98.59 billion. The leading cryptocurrencies, Bitcoin, Ethereum, and Ripple, have similarly exhibited bearish trends, indicating escalating pessimism among investors. Continuous negative influences may lead these assets to test critical support levels in the near future.

In the past month, the crypto market has predominantly shown bearish behavior, resulting in significant drops in the values of top cryptocurrencies. Bitcoin, Ethereum, and XRP have all experienced sharp declines, prompting caution among market participants regarding potential further downturns. Investors considering acquisitions of these tokens may find the short-term outlook concerning.

Bitcoin (BTC) has recorded a marginal decline of approximately 1% over the past 24 hours amidst a substantial trading volume of $34.188 billion. However, it has achieved a 3.38% increase over the past week and a 3.89% gain year-to-date, holding a market capitalization of $1.923 trillion and a dominance of 60.81%. Technical analysis reveals a consistently bearish trend, with key price levels established around $96,000 and potential support at $92,000.

Ethereum (ETH) has shown resilience with a 5% rise over the last week but suffers from an 18.56% drop in the past month and a year-to-date loss of 20.87%. This decline illustrates a growing bearish sentiment within the market. Should a bullish reversal materialize, ETH might reach resistance around $2,870; conversely, continued bearish trends could push it down to supports at $2,530.

XRP has experienced a 4.11% drop in the last 24 hours, despite a notable increase in volume, representing a year-to-date gain of 15.21%. With a market cap of $138.416 billion, XRP remains in the fourth position. The technical indicators point to increased bearish sentiment, with the potential for recovery to $3.00 if bullish momentum returns, or a decline toward $2.00 if bearish trends persist.

Among frequent inquiries, many investors ask why Bitcoin is falling, attributing it to global market uncertainties. The crashes in Ethereum are linked to rising selling pressure and reduced trading volume. While some speculate if XRP could reach $100, current sentiments suggest such a target is improbable.

This article discusses the current market conditions for major cryptocurrencies, specifically Bitcoin, Ethereum, and XRP. It highlights recent price trends and the prevailing bearish sentiment affecting these digital currencies. The article aims to provide insights for investors regarding potential price movements in the coming week.

In summary, the cryptocurrency market continues to navigate through bearish conditions, heavily influencing Bitcoin, Ethereum, and XRP. Each asset is approaching significant support and resistance levels, presenting both opportunities and risks for potential investors. Analysts suggest closely monitoring market trends and technical indicators for informed decision-making in this volatile market environment.

Original Source: coinpedia.org

Post Comment