Bitcoin Price Stuck in Consolidation: Is a Major Movement Approaching?

Bitcoin is consolidating above the $95,000 support level and must settle over $100,000 for a bullish trend to initiate. After testing $94,200, the price has recovered to above $96,500. Key resistance is at $98,500, while critical support exists around $96,200 and $94,200, factors that may influence future price movements.

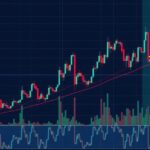

Bitcoin is presently showing signs of consolidation above the significant support level of $95,000. For a positive momentum to initiate, Bitcoin (BTC) must decisively settle above the $100,000 marker in the near future. Currently, the price experienced some increase from the $94,200 area, trading above $96,500 in line with the 100-hour Simple Moving Average.

Furthermore, a break occurred above a bearish trend line, concerning resistance at $96,000, as observed on the hourly chart of the BTC/USD pair, facilitated through data from Kraken. Continued upward movement may be seen if Bitcoin surpasses the $98,500 threshold, potentially paving the way for a substantial price surge.

Despite initial downturns below the $95,000 support, Bitcoin has made a noteworthy rebound, recently moving above both the $95,000 and $96,000 levels. A critical 50% Fibonacci retracement from the preceding downward trend marked by a high of $98,440 to a low of $94,111 has been surpassed, further reinforcing recent gains. Presently, Bitcoin is above the 61.8% Fibonacci retracement zone, indicating a potentially bullish trend.

On the immediate horizon, Bitcoin faces resistance near the $98,000 level, with key resistance levels set at $98,500 and $99,500. A breakout beyond $99,500 could lead to significant upward progression, potentially reaching the $100,000 resistance level, followed by targets at $100,500 and $102,000.

Conversely, should Bitcoin fail to breach the $98,500 resistance zone, a fresh decline may ensue. Key immediate support is identified near the $97,200 level, while major support levels are at $96,750 and $96,200. Further losses could bring the price closer to the pivotal $95,000 support, with critical support ultimately positioned at $94,200.

The technical indicators highlight a slight easing in the bullish momentum of the Hourly MACD, yet the Relative Strength Index remains above the neutral mark of 50, indicating ongoing strength. Investors should monitor these dynamics closely as Bitcoin navigates through these critical levels.

In summary, Bitcoin is currently consolidating above the crucial support of $95,000 while aiming to overcome resistance levels around $98,500 and $99,500 to establish a bullish momentum. A failure to break through these levels could lead to potential declines towards the support zones at $96,200 and $94,200, essential for maintaining upward trajectory. Observing the technical indicators will further inform potential movements in the Bitcoin market.

Original Source: www.tradingview.com

Post Comment