Bitcoin Price Analysis: Current Trends and Market Sentiment

Bitcoin is trading in a narrow range with support near $92,000 and resistance at $100,000. The future price action remains uncertain, with potential scenarios including a further decline below $80,000 or a recovery towards a new all-time high. Technical indicators and on-chain data suggest conflicting market sentiments, thus warranting close observation of key support levels.

Bitcoin (BTC) is currently trading within a narrow range, leading to uncertainty regarding its next movements. After breaking below the $100,000 threshold, Bitcoin is encountering resistance at higher price levels while finding support around $92,000. The critical questions at this juncture are whether Bitcoin will undergo a significant correction, potentially dropping below $80,000, or if it will mount a recovery towards a new all-time high (ATH).

On examining the daily chart, Bitcoin’s price action has been relatively stagnant over the past few weeks, showing no clear indication of a decisive breakout. The price remains capped below the significant $100,000 resistance level and finds support near the $92,000 zone. The Relative Strength Index (RSI) remains below 50%, indicating a bearish momentum, although Bitcoin stays above the key 200-day moving average (MA), currently situated around $80,000.

The 200-day MA serves as an essential support level, pivotal for Bitcoin’s future direction. Should Bitcoin encounter additional selling pressure leading to a decline towards the $80,000 range, it may face a more substantial correction before a potential bullish trend emerges. Conversely, sustaining above this support level could enable consolidation and strength-building for a future breakout.

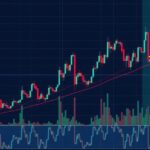

Shifting focus to the 4-hour chart, Bitcoin has been forming a symmetrical triangle pattern, indicative of market indecision. This pattern emerges when the price fluctuates between converging trendlines, with the subsequent breakout direction often determining the major movement. Recently, the price encountered resistance at the upper triangle boundary before being rejected.

Currently, as the price tests the triangle’s lower boundary, a bearish movement in the short term appears possible. The RSI has dipped below 50%, reinforcing the notion that sellers may have gained control. Should Bitcoin breach the lower trendline, it could lead to a decline towards the $92,000 level, while a breakout above the upper trendline may trigger a bullish rally towards higher prices.

Engaging in on-chain analysis offers insights into Bitcoin’s current market sentiment, specifically through the metric of BTC exchange reserves. An increase in exchange reserves often implies that market participants are preparing to sell, contributing to selling pressure. Conversely, a decline in reserves suggests accumulation or diminished selling interest. Recent weeks have seen a decrease in Bitcoin’s exchange reserves, indicating reduced selling pressure. However, a recent uptick in these reserves introduces some market uncertainty, signaling potential price decline as more traders may seek to liquidate their holdings.

Bitcoin’s price finds itself at a critical crossroads, as the price action on both the daily and 4-hour charts indicates the likelihood of either a significant breakdown or a recovery towards new ATH levels. Investors should closely observe the $80,000 level, which might act as a pivotal point for Bitcoin’s upcoming movements. While the overall market sentiment remains mixed—with some indicators suggesting bearish trends and others signaling a potential bullish continuation—Bitcoin’s future trajectory hinges on the performance of these key price levels in the coming weeks. Staying informed and prepared for volatility in the cryptocurrency market remains crucial.

In summary, Bitcoin is currently experiencing price volatility, trading within a tight range with critical support at $92,000 and resistance at $100,000. Both technical and on-chain analyses indicate potential bearish movements if support levels fail, while a breakout could lead to gains. Monitoring the critical $80,000 support and market sentiments remains vital for investors as Bitcoin’s future actions unfold.

Original Source: thecurrencyanalytics.com

Post Comment