Bitcoin Price Decline: Analysis and Future Prospects

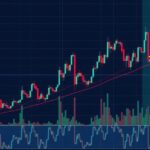

Bitcoin has dropped below the $90,000 support level after failing to maintain $95,500. Immediate resistance levels are noted at $89,000 and $90,000, while support is positioned at $86,000. Technical indicators suggest a bearish trend, indicating possible further declines if the price does not recover.

Bitcoin’s recent price action reveals a decline that commenced from the $95,500 zone, leading to trading below the crucial $90,000 support level. To mitigate further losses, Bitcoin must maintain a position above the $86,000 range. A short-term triangle may be forming, with immediate resistance detected at $89,000 on the hourly BTC/USD chart, supported by data from Kraken.

The price experienced a significant drop, failing to sustain above the $95,500 mark, subsequently plunging past the $93,200 and $92,200 support thresholds. Bitcoin dipped below $90,000, reaching as low as $86,000, where it now seeks to consolidate its losses. Current trading levels show recovery above $88,500 while also testing the 23.6% Fibonacci retracement level from the previous downward movement.

Bitcoin presently trades beneath $91,200 and the 100-hourly Simple Moving Average, with resistance seen around the $89,000 mark. Key resistance levels include $90,000 and $91,250, the latter being the 50% Fibonacci retracement level from the swing high of $96,482 to the low of $86,000. Should the price close above $91,250, it could propel the asset higher towards $93,500, with further increases possibly reaching $95,000 or even $96,400.

If Bitcoin is unable to surpass the $90,000 resistance, it may trigger another decline. Potential immediate support levels are identified at $88,000 and $87,250, with a major support threshold occurring around $86,000. Significant losses might result in a drop towards $85,000 in the near term, while the primary support remains positioned at $83,200.

Technical indicators portray a bearish outlook, with the Hourly MACD showing a waning downward momentum. The Relative Strength Index (RSI) for BTC/USD is currently below the neutral 50 level, further confirming bearish sentiment in the market.

In summary, Bitcoin has experienced a notable price decline since failing to maintain support at $95,500. The cryptocurrency must remain above the $86,000 mark to avoid deeper losses, with specific resistance points at $90,000 and $91,250 that could dictate future movements. As technical indicators reflect a bearish trend, Bitcoin’s next maneuver will be critical in determining its immediate market trajectory.

Original Source: www.tradingview.com

Post Comment