Bitcoin Price Surge: Insights and Future Projections

Bitcoin has surged to $92,000, gaining nearly 5% in a day amid heightened optimism linked to Donald Trump’s crypto summit. Analysts are observing the correlation between Bitcoin’s price and the M2 money supply, forecasting a rally from March to May 2025. Experts suggest that increasing global liquidity and favorable economic conditions may further support Bitcoin’s rise, with projections reaching up to $1 million by the end of the decade.

Bitcoin has recently soared to $92,000, marking a gain of nearly 5% within 24 hours, largely attributed to anticipation surrounding Donald Trump’s upcoming crypto summit at the White House. Following this rally, Bitcoin peaked at $92,760, experiencing stabilizing fluctuations around $91,500. Notably, this uptrend has prompted positive momentum in other cryptocurrencies such as Solana (SOL), XRP, and Dogecoin (DOGE), which are also exhibiting signs of growth.

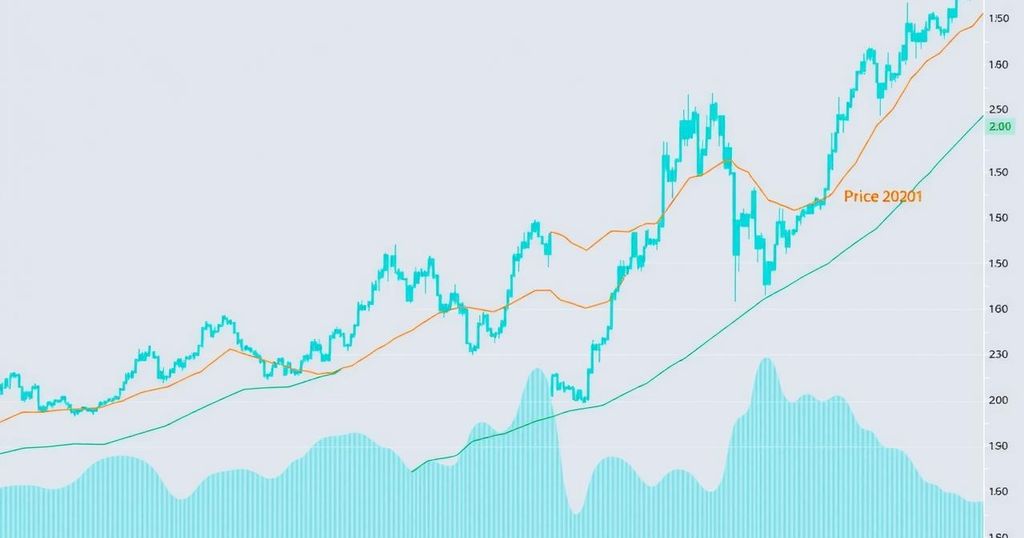

Experts are meticulously monitoring the global M2 money supply, which encompasses financial liquidity, including cash, deposits, and near-money assets. There is a historical correlation between Bitcoin’s price and M2 expansion, as increased liquidity typically boosts demand for alternative assets like cryptocurrencies. Since late 2024, M2 has been on a sharp upward trajectory, leading analysts to forecast a significant Bitcoin rally between late March and mid-May 2025.

Crypto analyst Colin Talks Crypto has identified a notable surge in global M2, illustrating this as a “vertical line” on the charts, signaling potential asset price increases. He anticipates that the rally in Bitcoin, along with stocks and the wider crypto market, will commence on March 25 and persist until May 14.

Historical trends reveal that the rapid M2 growth during the COVID-19 pandemic coincided with one of Bitcoin’s most prosperous bull markets. During this period, substantial monetary influx propelled Bitcoin prices as investors sought refuge from inflation-induced currency devaluation. Conversely, lesser liquidity often constrains Bitcoin prices due to reduced funds for speculative investments.

Vandell, co-founder of Black Swan Capitalist, asserts that fluctuations in global M2 directly influence Bitcoin’s market trajectory, noting a typical ten-week delay in Bitcoin’s response following M2 declines. He acknowledges potential short-term price corrections but believes the current cycle is positioned for sustained long-term gains.

Renowned crypto analyst Michaël van de Poppe identifies M2 expansion as pivotal for an impending market recovery. He emphasizes that decreased inflation, anticipated rate cuts from the U.S. Federal Reserve, and a declining dollar enhance financial conditions favorable to Bitcoin and altcoins alike.

Economist Tomas draws comparisons between the current market landscape and previous notable cycles in 2017 and 2020, where rising M2 levels mirrored Bitcoin’s peak performance years. He posits the potential for a similar uptrend in 2025, contingent on the US dollar’s depreciation.

Macro researcher Yimin Xu forecasts the Federal Reserve could pause its Quantitative Tightening (QT) measures later this year, potentially shifting toward Quantitative Easing (QE) as economic conditions evolve. This action would bring additional liquidity into the market, further bolstering Bitcoin’s positive outlook.

With increasing liquidity, shifting Federal Reserve policies, and the potential for political changes in the U.S., analysts speculate that Bitcoin may soon embark on another major rally. March is regarded as a significant month for cryptocurrency investors, who are closely monitoring these developments for market opportunities.

Currently, Bitcoin prices are estimated to fluctuate within the range of $90,000 to $95,000. According to Coinpedia’s BTC price prediction, Bitcoin could reach a peak of $169,046 this year if bullish trends continue. Additionally, with enhanced adoption, projections indicate Bitcoin might attain values of $610,646 by 2030. Some forecasts are even bolder, suggesting a potential valuation of $1 million per Bitcoin during this decade.

In summary, the recent surge in Bitcoin price showcases a growing bullish sentiment reinforced by favorable economic conditions and historical correlations with the M2 money supply. As analysts predict a significant rally beginning in late March and continuing into mid-May 2025, investors are advised to remain vigilant. With potential price peaks and increased adoption on the horizon, the future of Bitcoin appears promising, and the market is primed for notable developments.

Original Source: coinpedia.org

Post Comment