Understanding Bitcoin Price Trends and Their Effects on Rutland Investors

This article discusses the importance of understanding Bitcoin price trends for Rutland investors amid ongoing volatility. It highlights recent price fluctuations driven by institutional interest, the local engagement with cryptocurrency, and the challenges businesses face in adopting Bitcoin. The article also outlines the risks associated with Bitcoin investment and emphasizes the need for educational programs to prepare the community for future developments in digital assets.

The prominence of Bitcoin as a significant digital asset continues to rise, making it essential for community members in Rutland to grasp its price trends. This understanding is critical in navigating the volatility surrounding the cryptocurrency, which poses challenges for both experienced and novice investors alike.

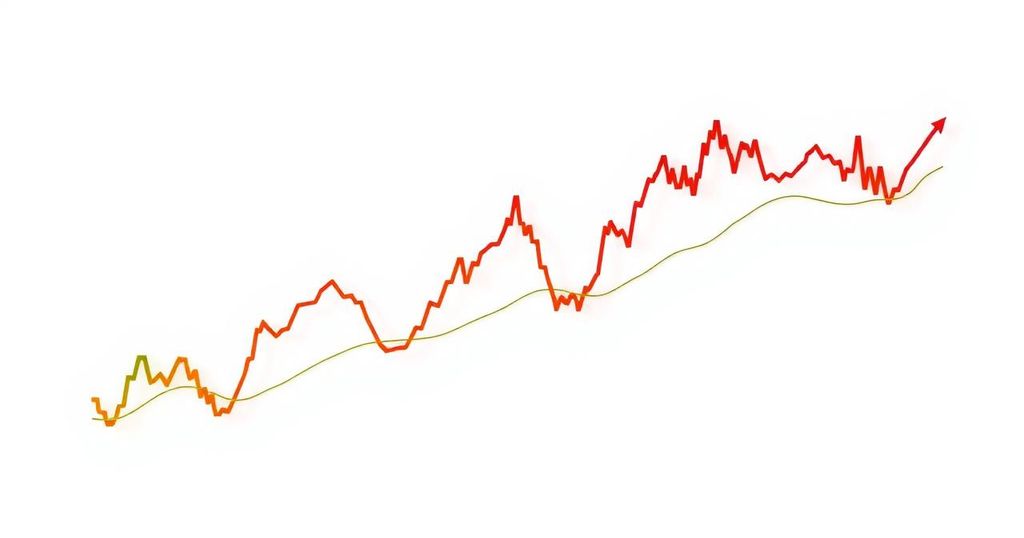

Over the past year, Bitcoin has exhibited notable price fluctuations influenced by various macroeconomic and regulatory factors, as well as increasing institutional adoption. Starting the year at approximately $88,465, its value peaked above $109,000 before subsequently declining. Market analysts point out institutional interest in Bitcoin ETFs, although comprehensive inflow records are elusive. They emphasize that Bitcoin’s scarcity, driven by its halving cycle, may significantly impact future price developments, affecting local Rutland investors experiencing these market changes.

As Bitcoin garners considerable attention, Vermont residents, particularly in Rutland, are showing a growing interest in cryptocurrency investments. The USA remains a pivotal player in Bitcoin mining and trading, as reported by The Cambridge Centre for Alternative Finance, indicating rising engagement with digital assets. Despite previous explorations of blockchain technology by Vermont’s Department of Financial Regulation, a lack of publicly accessible information on local investment practices persists, with many residents still relying on traditional investing methods.

In other parts of the U.S., small businesses have embraced Bitcoin payments, yet Vermont has not widely adopted this trend. While some local businesses explore cryptocurrency transactions, a historical precedent exists with Burlington’s Blu-Bin, a 3D printing shop that previously accepted Bitcoin, although its current status remains uncertain. Bitcoin offers reduced transaction costs compared to credit cards, typically around 1% or less; however, network activity can cause variability in fees.

Nevertheless, potential investors should be mindful of Bitcoin’s risks, including its significant volatility, regulatory uncertainties, security threats, and market speculation. These factors may deter some individuals from investing, as rapid value changes can lead to substantial gains or losses within short time frames.

In the long run, the impact of Bitcoin on the local Rutland economy could intensify with increasing interest from investors and businesses alike. Educational programs focusing on blockchain and cryptocurrency will equip residents with essential financial knowledge. Interest in related workshops, such as those at the Vermont Blockchain Summit in Burlington, demonstrates an eagerness for deeper understanding among the community. Vermont universities are introducing courses on blockchain technology, further enhancing learners’ comprehension of decentralized finance.

The ongoing evolution of digital currencies necessitates consideration from policymakers and financial institutions regarding Vermont’s economy. Bitcoin is poised to have a lasting influence, shaping investment patterns, payment systems, and regulatory frameworks in the future.

In conclusion, Bitcoin remains a dynamic asset with the potential to significantly influence various aspects of the economy, particularly in Rutland. Investors and businesses have the opportunity to navigate the benefits and challenges that cryptocurrency presents, emphasizing the importance of awareness and education in the evolving financial landscape. The community’s engagement with Bitcoin could very well shape its future economic developments.

Original Source: www.rutlandherald.com

Post Comment