Bitcoin Price Faces Potential Decline: An Analysis of Current Trends

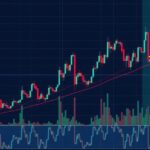

Bitcoin’s price has declined from $92,000 to below $85,500, indicating a potential downward trend. Support levels are critical at $80,000 and $78,000, while resistance at $83,000 could dictate future price action. A failure to rise above key resistance may result in further declines.

Bitcoin has experienced a notable decline, starting from the $92,000 range. The cryptocurrency is currently trading under $85,500 and is at risk of dropping below the $80,000 threshold. The recent downward trend stems from a failure to maintain the price above key support levels such as $85,000, with a specific bearish trend observed on the hourly chart of the BTC/USD pair.

Following a descent below the $88,000 mark, Bitcoin fell through several support levels, ultimately testing the $80,000 zone, reaching a low of $80,006. A temporary recovery occurred, pushing the price to overcome the $80,500 and $81,200 resistances, yet it remains below the crucial $85,000 and the 100-hourly Simple Moving Average. Immediate resistance now lies at $82,700, with significant resistance at $83,000 and a forming bearish trend line at $83,200.

Should Bitcoin fail to breach the $83,000 resistance, it may experience further declines. Support levels are currently identified at $81,000 and $80,200, with the main support at $80,000. A continued failure to maintain above these levels could result in further drops toward $78,000 and potentially even $75,000, should bearish momentum persist.

In conclusion, Bitcoin is navigating a precarious phase, having dropped from previous highs and encountering significant resistance levels. The cryptocurrency is at significant risk of further decline unless it can decisively overcome the resistance near $83,000. Key support levels are set at $80,000 and $78,000, which if breached, could lead to a deeper correction in the market.

Original Source: www.tradingview.com

Post Comment