Bitcoin Price Prediction 2025-2030: Analyzing the Path to $200,000

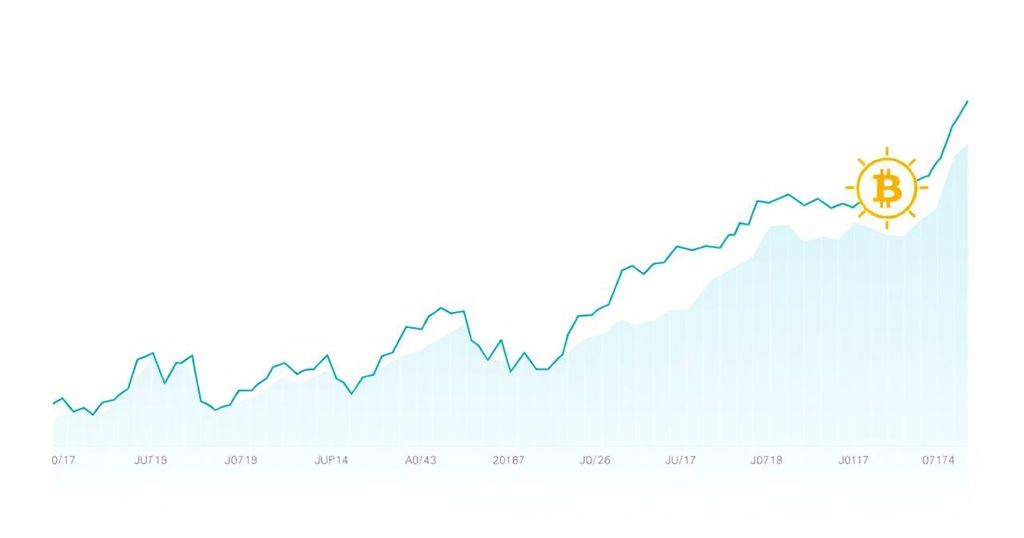

Bitcoin, currently priced at $82,922, may reach $200,000 by 2030, with projections suggesting a price of $170,000 by 2025. Factors influencing this include regulatory developments, market adoption, and macroeconomic conditions. While there are uncertainties and risks, the long-term outlook for Bitcoin remains optimistic.

Bitcoin, the foremost cryptocurrency, has garnered significant attention over its decade-long existence, with a current price of $82,922. Investors are increasingly questioning the potential for Bitcoin to reach $200,000 or higher. This article delves into predictions regarding Bitcoin’s price trajectory for 2025 through 2030, placing emphasis on factors influencing its value such as regulatory changes, global adoption, and market dynamics.

The cryptocurrency market is undergoing a period of volatility, particularly following the recent Non-Farm Payrolls report that pushed the Federal Reserve towards a more cautious monetary policy. This economic uncertainty has led to significant market liquidations, highlighting a precarious outlook for Bitcoin’s short-term performance. Investors are left unsure as to whether Bitcoin can maintain its upward momentum amid these fluctuations.

The future performance of Bitcoin largely hinges on the degree of regulatory advancements and expanded market acceptance. Japan’s ongoing exploration of key regulatory reforms, including potential tax cuts and Bitcoin Spot ETF approvals, could significantly bolster investor confidence and attract institutional capital, fostering a favorable environment for Bitcoin.

In the United States, the political landscape is also a critical factor. Speculation surrounding a possible second term for former President Trump, whose pro-cryptocurrency stance is well-known, could lead to policies that deepen Bitcoin’s market penetration, effectively increasing demand for the digital asset.

2025 is anticipated to be an impactful year for Bitcoin, with projections suggesting a price peak of $170,000. The potential for mainstream adoption across sectors, combined with Bitcoin’s limited supply capped at 21 million coins, could result in soaring demand and elevate its value significantly. Additionally, Bitcoin’s positioning as a hedge against inflation may make it a preferred investment during economic unease.

Looking towards 2030, experts speculate that Bitcoin’s value could soar to between $500,000 and $600,000, contingent upon sustained adoption, regulatory enhancements, and an influx of institutional investment. This optimistic forecast is grounded in the assumption of an expanding global community embracing cryptocurrencies, thereby integrating them more fully into financial ecosystems.

The prospect of Bitcoin achieving the $200,000 milestone appears plausible, bolstered by favorable regulations and growing cross-industry adoption. An increased acceptance of Bitcoin as a store of value might reinforce upward price pressures, paralleling gold’s status among traditional assets.

Nonetheless, Bitcoin’s journey remains fraught with challenges. Market volatility, regulatory hurdles, and competition from emerging cryptocurrencies pose significant risks to its stability and growth. Short-term price movements remain difficult to predict, as historical fluctuations, such as those during the 2021 bull run, have demonstrated significant unpredictability.

In conclusion, while predictions suggest a strong potential for Bitcoin to reach or surpass $200,000 by 2030, caution is warranted. Immediate forecasts of $170,000 for 2025 appear attainable, but ongoing developments in regulatory frameworks and institutional investment dynamics will significantly influence Bitcoin’s trajectory. Investors should remain vigilant as the landscape evolves, despite positive long-term prospects that offer substantial opportunities.

In summary, Bitcoin’s future holds considerable promise, with potential price targets of $170,000 by 2025 and speculation of reaching between $500,000 and $600,000 by 2030. The trajectory of Bitcoin will be shaped by various factors including regulatory changes, market acceptance, and its role as a hedge against inflation. However, investors must remain aware of potential risks and market volatility as they navigate their involvement in this dynamic cryptocurrency landscape.

Original Source: thecurrencyanalytics.com

Post Comment