Bitcoin Slips to $80K: Analyst Predictions and Market Insights

Bitcoin has fallen to $80,000, with analyst Arthur Hayes predicting a retest of $78,000, potentially leading to $75,000 if breached. Significant open interest in options suggests possible volatility. The market is reacting to recent panic selling and external factors, including tariffs and inflation reports that may influence future prices.

Bitcoin prices have experienced a significant decline, falling to approximately $80,000 on March 10. BitMEX co-founder Arthur Hayes remarked that this indicates an “ugly start” to the week, suggesting a potential retest of the $78,000 level. He noted that a failure to maintain this threshold could lead to a further drop to $75,000.

Hayes observed substantial open interest in Bitcoin options, particularly in the $70,000 to $75,000 range, intensifying potential volatility if prices enter that bracket. Data from Deribit showed around $696 million in open interest at the $70,000 strike and $659 million at $75,000, indicating strong speculation in the market as traders adopt short positions.

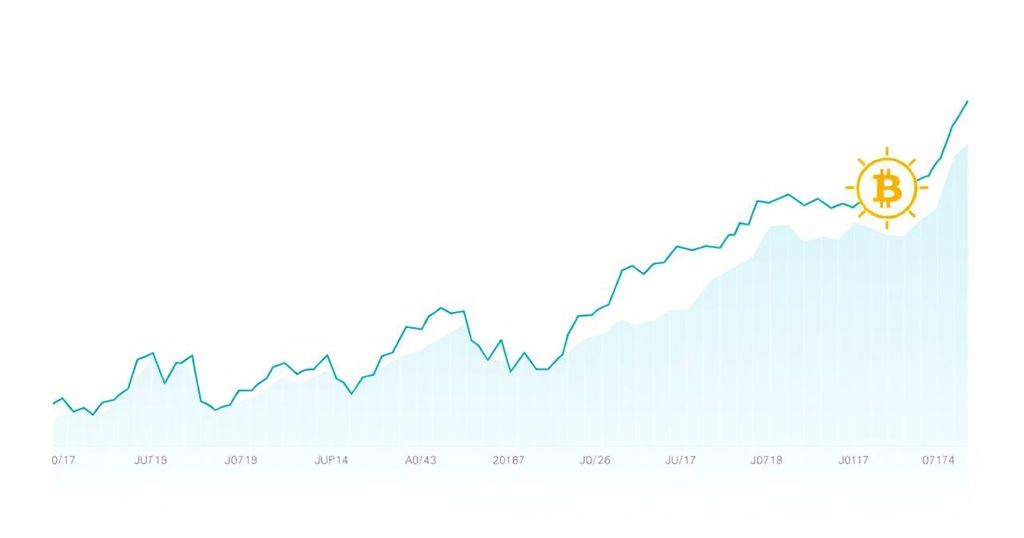

Following a 5% plunge, Bitcoin briefly dipped to $80,124 before a slight recovery brought it to $81,395. The cryptocurrency has displayed notable volatility recently, fluctuating between $80,000 and $95,000 amid various trade tariff news and White House cryptocurrency announcements.

Hayes previously predicted Bitcoin could fall to $75,000 before potentially rising to $250,000. His forecasts included a warning of a “goblin town” phase, where Bitcoin could hit $70,000 as hedge funds liquidate ETF positions. In late February, Bitcoin experienced its lowest drop for 2025, nearing the $78,000 mark.

Market research firm 10x Research characterized the current price movements as a “textbook correction,” revealing that approximately 70% of the recent selling activity originated from investors who had purchased Bitcoin within the past three months. This indicates a trend of panic selling among newer market entrants.

As of March 10, the Bitcoin Fear & Greed Index fell to a level indicative of “extreme fear,” recording a value of 20. Ongoing volatility is anticipated, particularly with two crucial inflation reports set to be released in the United States, which could impact the Federal Reserve’s monetary policy decisions.

The market is also reacting to Canada’s new tariffs as the Liberal Party elected Mark Carney, a former central banker, as president. In his victory speech, Carney voiced strong criticism against U.S. tariffs, asserting, “Americans should make no mistake … In trade, as in hockey, Canada will win.”

In summary, Bitcoin is undergoing a notable decline, having recently dipped below the $80,000 threshold. Analysts predict further volatility as the cryptocurrency may retest critical resistance levels, while market dynamics are compounded by recent shifts in investor sentiment and external economic factors. With the approaching inflation reports and geopolitical tensions, Bitcoin’s future movements will be closely monitored.

Original Source: cointelegraph.com

Post Comment