Bitcoin Price Forecast: Stabilization Around $83,000 Amid Economic Insights

Bitcoin (BTC) is trading at approximately $83,100, showing a recovery trend after recent softer US inflation data. Market analysts are cautious, anticipating US Producer Price Index data and jobless claims for further clarity. The BITCOIN Act of 2025 could fundamentally alter Bitcoin’s role in the U.S. financial landscape, while current metrics suggest potential bearish conditions in the market.

On Thursday, Bitcoin (BTC) is stabilized around $83,100 after a nearly 3% recovery this week. This shift follows softer-than-expected US Consumer Price Index (CPI) data reported Wednesday, which prompted market participants to anticipate forthcoming US Producer Price Index (PPI) data and initial weekly jobless claims for additional economic insights. A report by CryptoQuant suggests that Bitcoin could be entering a bear market phase.

The slight increase in Bitcoin’s price can be attributed to a report focusing on the US CPI data that evidenced both headline and core inflation diminishing more rapidly than anticipated. This led to speculation about possible interest rate cuts by the US Federal Reserve (Fed), consequently enhancing Bitcoin’s appeal among riskier assets. However, concerns over President Trump’s trade tariffs could drive investors toward safer investments amid uncertainties about economic downturns.

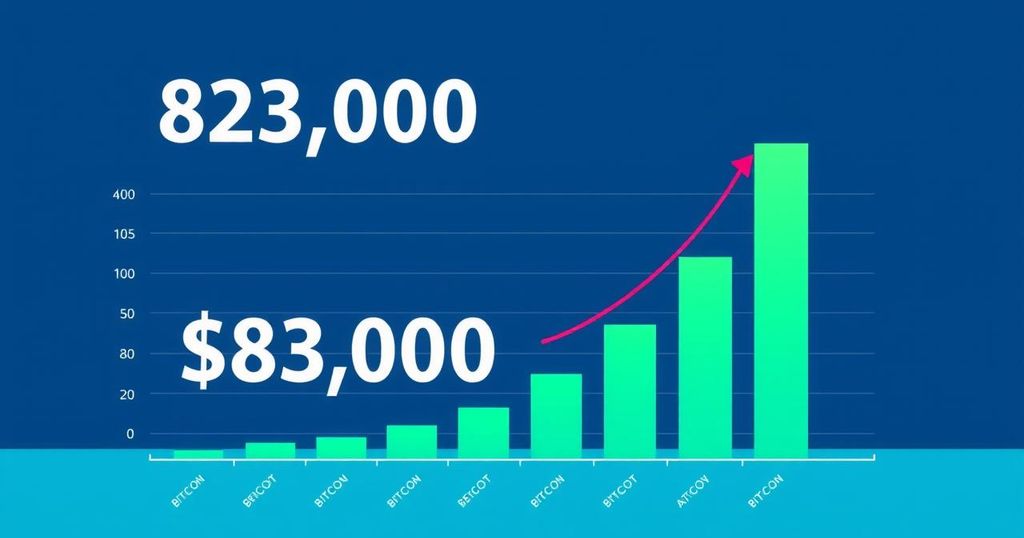

Congressman Nick Begich of Alaska proposed the BITCOIN Act of 2025, aimed at creating a US Strategic Bitcoin Reserve (SBR) to bolster national financial security and economic independence. The Act seeks to acquire 1 million Bitcoin over a five-year period, paralleling the scale of US Gold reserves. “Not a single taxpayer dollar will be used,” Begich asserted at the Bitcoin for America Summit, hinting at the transformative potential of the bill for U.S. financial policy.

A recent CryptoQuant report indicates that Bitcoin’s overall valuation metrics suggest the market may be entering bearish territory. Various indicators, including the Bitcoin Bull-Bear Market Cycle Indicator, show a significant bearish trend at present. Additionally, US-based spot ETFs appear to be net sellers of Bitcoin in 2025, further pressuring the asset’s price, a stark contrast to substantial net purchases recorded in the previous year.

Evaluating Bitcoin’s price action, the Relative Strength Index (RSI) reflects a bullish divergence, potentially signaling a trend reversal or short-term price increase if momentum continues positively. Conversely, should Bitcoin fail to hold its current support level, it may subsequently target a drop to around $63,000, depending on market fluctuations.

Bitcoin is acknowledged as the foremost cryptocurrency and operates independently of centralized control, making it unique in its transaction capabilities. Altcoins and stablecoins are defined differently; altcoins refer to any cryptocurrency apart from Bitcoin, while stablecoins maintain a steady price, often pegged to assets like the US Dollar. Moreover, Bitcoin dominance measures its market capitalization relative to the entire cryptocurrency market, providing insight into its investment appeal.

The insights shared in this article are subject to market risks and uncertainties. Investors are encouraged to perform comprehensive research before engaging in any financial transactions. Neither FXStreet nor the author holds responsibility for any inaccuracies within the content presented. The author holds no relevant positions in stocks discussed and has not received compensation for this article.

In summary, Bitcoin’s current trading price around $83,100 reflects a moderate recovery following favorable inflation analyses. However, pressures from traditional market risks may complicate its trajectory. The proposed BITCOIN Act of 2025 could critically influence future Bitcoin valuation and its role in U.S. fiscal policy. Market indicators signal possible bearish trends, urging investors to remain vigilant as they navigate the cryptocurrency landscape.

Original Source: www.fxstreet.com

Post Comment