Current Market Trends: A Halt in Bitcoin and Solana Price Declines?

The decline in Bitcoin and Solana prices may have temporarily halted, yet signs suggest the potential for further drops. Bitcoin’s recent stabilization contrasts with Solana’s consistent decline since February. The market’s future trajectory remains heavily influenced by Bitcoin’s performance, with caution advised for upcoming trends.

Recent trends suggest that the decline in the prices of Bitcoin and Solana may have come to a halt. However, caution is warranted, as the potential for a new downward phase remains. Notably, the price movements of these two cryptocurrencies differ significantly during this period of volatility.

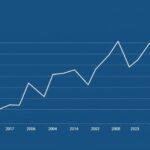

Bitcoin’s price stabilized slightly on Saturday, hovering above $85,000 after experiencing a notable decrease from $92,000 earlier in March. This drop aligns with a bear trend that began in early February, which saw Bitcoin’s price plummet from $105,000 and subsequently dip below $79,000. Ultimately, the price only briefly rebounded before dropping below $80,000 again.

Conversely, Solana’s native cryptocurrency, SOL, has faced a more consistent decline without the abrupt drops characteristic of Bitcoin’s movements. Following peaks of nearly $290 in January, Solana’s price returned to around $200 before losing significant ground in mid-February, ultimately declining further to around $130. As a result, Solana’s current position is notably lower than before Trump’s electoral victory.

Currently, Bitcoin’s price trends appear to dictate the medium-term prospects for the crypto market, with altcoins trailing behind. Bitcoin’s dominance has risen to over 62%, the highest rate seen since March 2021, indicating a market reliant on Bitcoin’s volatility as altseason gives way to a Bitcoin season.

While a decline could resume for both Bitcoin and Solana, clear signals for a bullish recovery remain absent. The possibilities include Bitcoin’s potential drop to levels between $74,000 and $70,000. Should this occur, Solana’s price may also continue its decline. The first significant target for SOL, should it fail to maintain the $125 mark, could be at $90, considering historical price trends.

In summary, while the recent price declines of Bitcoin and Solana appear to have halted for the moment, investor caution is warranted given the possibility of resuming downward trends. Bitcoin’s performance continues to influence the broader market dynamics, with Solana showing more steady declines. Future price predictions suggest further potential drops may occur, particularly for Bitcoin, while Solana’s targets are similarly shaky amidst historical comparisons.

Original Source: en.cryptonomist.ch

Post Comment