Bitcoin Price Predicted to Surge Beyond $130,000 Following Cup and Handle Formation

Bitcoin is currently trading between $84,000 and $82,000, facing pressure from market sentiment. Analysis reveals a cup-and-handle pattern suggesting a potential rally to over $130,000. Elliott wave analysis supports this bullish outlook, although current market fundamentals show uncertainty and decreased institutional investment.

Recent Bitcoin price activity indicates that the cryptocurrency is currently consolidating in a narrow range between $84,000 and $82,000, with bullish momentum proving elusive. The general market sentiment reflects caution, leading to diminishing hopes for a rapid resurgence above $90,000. However, technical analysis reveals that Bitcoin is potentially set for significant price movement due to the emergence of a cup-and-handle pattern.

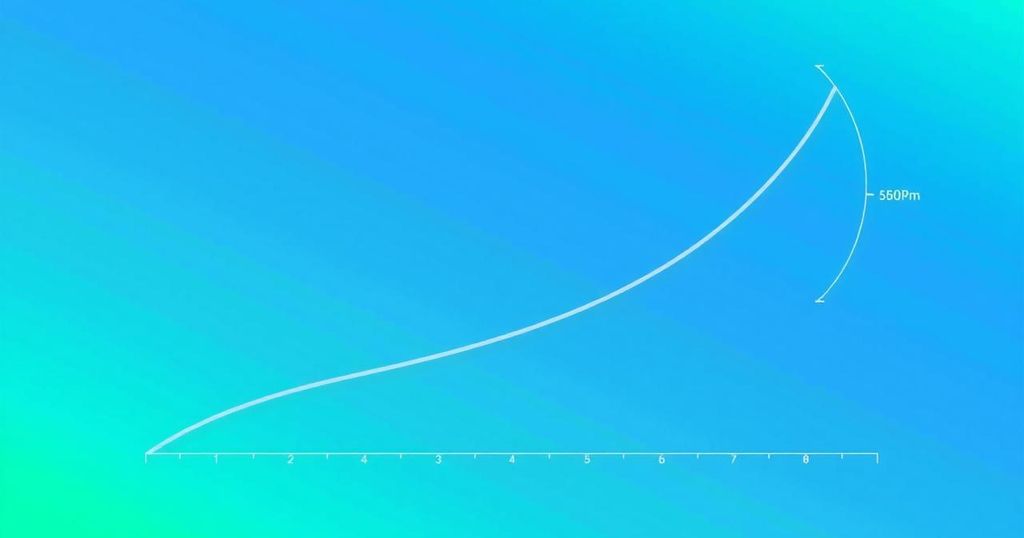

This cup-and-handle pattern, crucial in chart analysis, has been developing over several years, with the rounded bottom observed from 2021 to mid-2024. This phase of accumulation allowed Bitcoin to recover from a bearish cycle, followed by a breakout that initiated the handle formation in the latter half of 2024. Following this, by November 2024, Bitcoin saw an impressive rally, reaching a peak of $108,786 in January 2025 before a 24% correction ensued. This correction has brought Bitcoin back to the neckline resistance of the cup-and-handle, creating potential for a rebound from this support level. Analysts’ forecasts place Bitcoin’s price target notably above $130,000.

Utilizing the Elliott Waves technical framework, experts suggest that Bitcoin is currently navigating through a larger fifth impulse wave, which is typically bullish. Recently, corrective ABC sub-waves interrupted this phase, yet with support from the cup-and-handle confirmed, Bitcoin should position itself for a price bounce. This movement is anticipated to propel Bitcoin towards achieving the forecasted target exceeding $130,000.

While the technical indicators hint at a forthcoming breakout, Bitcoin’s current circumstances reveal a degree of fundamental uncertainty. There is insufficient bullish momentum to recapture the $90,000 mark, which is essential for progressing toward the $130,000 target. Furthermore, a steady outflow of institutional investment from Spot Bitcoin ETFs has added downward pressure, hindering Bitcoin’s short-term recovery. As of this writing, Bitcoin is trading at $83,500.

In conclusion, Bitcoin is potentially on the cusp of a substantial rally, guided by the formation of a cup-and-handle pattern and supporting Elliott wave analysis. While technical indicators suggest a price target of over $130,000, short-term fundamentals exhibit caution due to waning bullish momentum and institutional outflows. The coming months will be pivotal as Bitcoin seeks to overcome immediate resistances.

Original Source: www.tradingview.com

Post Comment