Politics

ASIA, CRUDE OIL IMPORTS, EUROPE, EUROPE/ASIA, GLOBAL ECONOMY, HAZIRA, HMEL, HPCL MITTAL ENERGY LTD, INDIA, INTERNATIONAL TRADE, JORGE LEON, KPLER, LUGA, MIDDLE, MUNDRA, NORTH AMERICA, NOVOROSSIYSK, OIL PRICES, PR, PRABH DAS, REUTERS, RUSSIA, RYSTAD ENERGY, SHESKHARIS, SIKKA, TRADE, TRUMP, U. S, UAE, UKRAINE, UNITED STATES, US, UST, UST - LUGA

Dante Raeburn

Russia Surpasses UAE as Top Naphtha Supplier to India in 2024-2025

Russia has become the leading supplier of naphtha to India for 2024-2025, providing over 50% of imports, a significant increase from previous years. The UAE’s market share has declined to just over 20%. Lower prices for Russian naphtha make it attractive for refiners amid rising domestic petrochemical demand. Geopolitical factors continue to influence the dynamics of oil imports in Asia.

In 2024-2025, Russia has surpassed the United Arab Emirates (UAE) as India’s leading naphtha supplier, providing over half of India’s total imports, which amounted to approximately 3 million tons (equivalent to 74,000 barrels per day). This significant increase from the previous year’s 14%-16% share highlights a shift in sourcing strategies, as reported by ship-tracking data from OilX and Kpler.

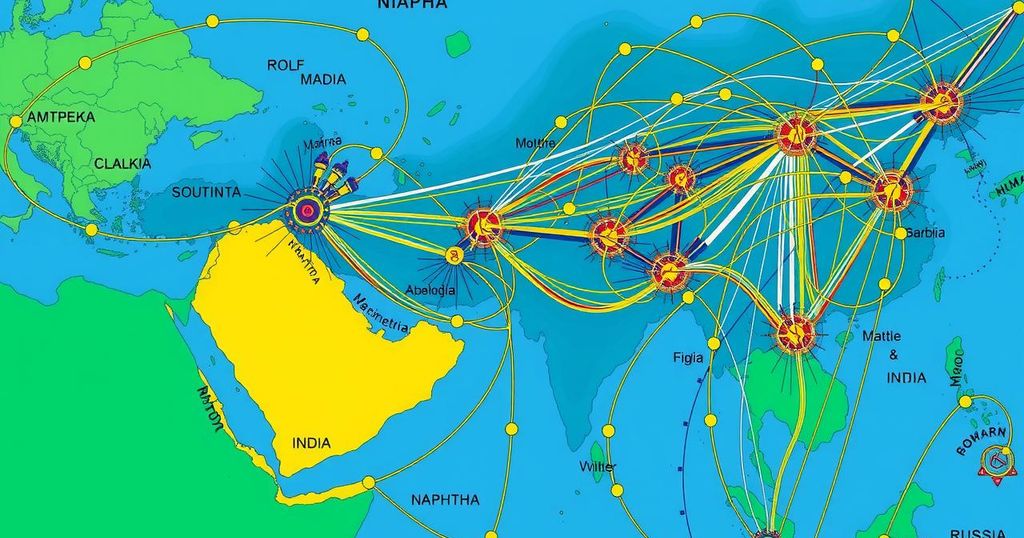

Russian naphtha is predominantly transported from the ports of Ust-Luga, Sheskharis, and Novorossiysk to western Indian ports, including Mundra, Hazira, and Sikka, serving the petrochemical facilities of HPCL Mittal Energy Ltd (HMEL) and Reliance Industries.

HMEL’s Chairman, Prabh Das, acknowledged that pricing influences sourcing decisions, stating, “We will buy from wherever it is cheaper,” although he refrained from addressing specific purchases of Russian oil. Reports indicate that Russian naphtha is currently priced at $14-$15 per ton below Middle Eastern alternatives, enhancing its attractiveness to Indian refiners.

Despite being the seventh largest naphtha importer in Asia, India’s import volume is expected to increase due to escalating domestic demand for petrochemicals and the establishment of new crackers within the next three to four years. Conversely, the UAE’s share of the market has decreased to just over 20%, a decline that reflects half of its performance during the previous period.

A representative from an integrated refining complex in northern India remarked that the lower margins experienced in the Indian market this year have driven refiners to favor more affordable feedstock, noting, “Prices have been attractive for us and we will continue to purchase from them (Russia).” Following the European sanctions on Russian oil due to the 2022 Ukraine invasion, Russia has redirected its naphtha exports to Asian nations.

Analysts predict that the ongoing negotiations regarding a Ukraine ceasefire may potentially result in the lifting of sanctions on Russian oil; however, European nations may persist in avoiding Russian imports, even if U.S. sanctions are rescinded, according to Rystad Energy analyst Jorge Leon.

In conclusion, Russia’s emergence as India’s primary naphtha supplier marks a significant shift in the energy landscape, driven by competitive pricing and increasing domestic demand for petrochemicals. The decline in the UAE’s market share further emphasizes the changes in sourcing strategies following geopolitical tensions. The future of Russian oil imports into Asia remains a complex issue, influenced by sanctions and market dynamics, indicating a new era in regional energy trade.

Original Source: m.economictimes.com

Post Comment