Analysts Forecast Bitcoin May Achieve $200,000 Amid Market Growth

SNXCrypto analysts predict Bitcoin may rise to between $150,000 and $200,000 due to factors such as increased institutional adoption and regulatory clarity. Historical trends following halving events suggest continued bullish momentum in the cryptocurrency market. Investors are advised to remain informed about market dynamics and consider various scenarios for future investments.

In a recent analysis, SNXCrypto, a professional cryptocurrency platform, discusses the potential for Bitcoin to reach prices as high as $150,000 or $200,000 following a significant surge in its value. Analysts attribute this bullish momentum to various factors, despite some market caution regarding future fluctuations. The report emphasizes institutional use, economic influences, and advancements in regulatory environments as catalysts for ongoing price increases.

Key drivers of Bitcoin’s expected surge include substantial institutional and national adoption, which is enhancing demand for the cryptocurrency. Furthermore, historical patterns suggest Bitcoin typically witnesses major price hikes post-halving events, with predictions indicating a possible surge to $150,000 by late 2025. Additionally, as mainstream financial institutions integrate Bitcoin into their services, adoption rates will continue to climb.

The influx of institutional investors has significantly propelled Bitcoin’s market presence, with corporations like Tesla and MicroStrategy holding Bitcoin to fortify their assets. The growing acceptance of Bitcoin as “digital gold” bolsters its appeal across investment sectors, while investment products offered by financial institutions enhance accessibility for a broader audience.

Amid rising inflation and economic uncertainty, Bitcoin has emerged as a viable store of value. Its decentralized nature and limited supply position it as a protective asset against currency devaluation, increasingly appealing to investors amid central banks’ expansive monetary policies.

Regulatory advancements, particularly the approval of Bitcoin Exchange-Traded Funds (ETFs), have validated Bitcoin’s status as a financial asset, lowering barriers to entry for investors. The established cap of 21 million bitcoins and scheduled halving events further add to the supply constraints that historically contribute to long-term price appreciation.

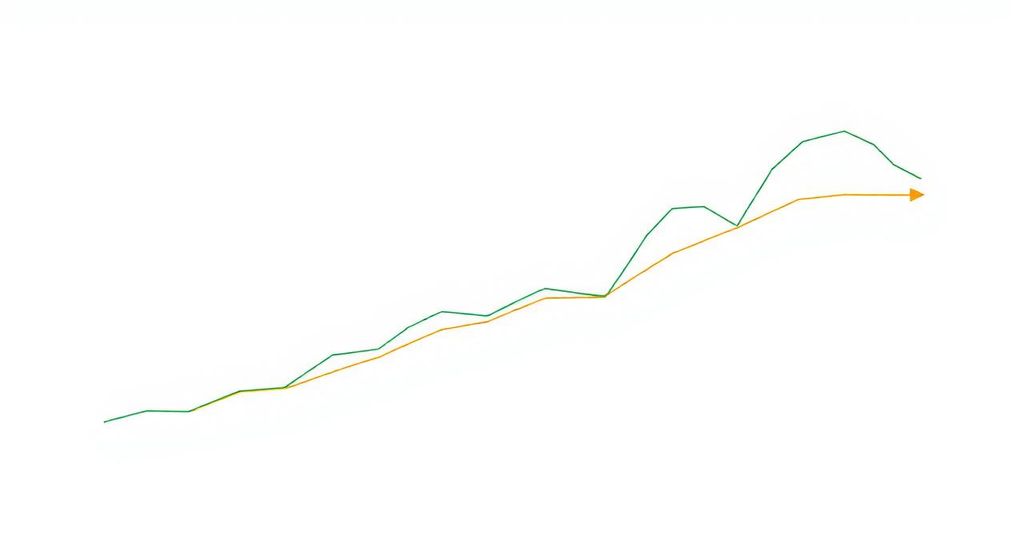

Bitcoin’s impressive increase from $20,000 to $100,000 highlights its resilience and evolving role in finance. While uncertainties remain, ongoing trends such as institutional adoption and regulatory clarity suggest that reaching $150,000 or $200,000 is feasible in the future. Investors are encouraged to consider both optimistic and pessimistic market scenarios, while continuing to monitor market conditions.

SNXCrypto is committed to delivering comprehensive market insights and investment strategies for both institutional and retail investors. The platform seeks to provide thorough research on Bitcoin and the wider cryptocurrency market to facilitate informed investment decisions. For additional information and updates on the Bitcoin market, please visit SNXCrypto’s official website.

In summary, SNXCrypto’s analysis indicates a strong potential for Bitcoin to reach $150,000 or even $200,000, driven by institutional adoption, regulatory advancements, and macroeconomic factors such as inflation. The cryptocurrency’s rising acceptance as a legitimate financial asset, alongside historical patterns post-halving, supports this optimistic outlook. Investors should stay vigilant and consider various market scenarios as they navigate their investment strategies in this dynamic financial landscape.

Original Source: www.globenewswire.com

Post Comment