Bitcoin (BTC) Price Prediction & Analysis: Resistance at $87k and Market Dynamics Ahead

Bitcoin has dropped below $85,000, falling around 2% in 24 hours. Liquidations are at $200 million, mainly in long positions. Technical indicators show support near $83,000, while U.S. Bitcoin ETFs report consistent inflows, led by BlackRock. Analysts highlight resistance at $87,000 and potential price volatility ahead.

Bitcoin has recently experienced a price decline, dropping below the $85,000 threshold, which reflects a decrease of approximately 2% over the last 24 hours. The cryptocurrency faces significant resistance at the $87,000 mark, following a peak of $87,500 recorded on March 20. This downturn is characterized by market liquidations nearing $200 million, primarily affecting long positions, which comprise about $131 million of the total.

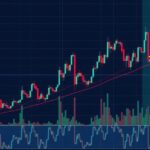

Technically, Bitcoin is currently trading within a rising channel pattern and has tested a critical resistance trendline. The asset’s inability to maintain the 23.60% Fibonacci level at $84,841 indicates a potential ongoing bearish momentum, as Bitcoin is forming notable price rejection candles. Support at the 50 EMA has provided temporary respite; however, indicators such as the MACD suggest a possible sell-off and a daily RSI below 50 points to continued bearish sentiment unless buying pressure strengthens.

The liquidation events in the crypto space reveal a concerning trend, with long liquidations dominating amidst the price decline. Additionally, open interest has witnessed a decline of 4.45%, settling at approximately $52.81 billion, with a slight increase in the bearish long-to-short ratio now at 0.9861. Despite prevailing bearish indicators, the open interest at a rate of 0.0051% still hints at some underlying bullishness in the market.

Whales have been actively repositioning, moving from long to short contracts, prompting concerns about market leverage and the potential for sharp price corrections. Analyses have noted that this shift may be a strategy by larger traders, employing tactics such as “spoofing” to create artificial sell pressure on Bitcoin’s price, particularly around $89,000.

Nonetheless, institutional interest in Bitcoin remains buoyant. The recent inflows into U.S. spot Bitcoin ETFs indicate a growing commitment, with total net inflows of $165.75 million recorded on March 20. BlackRock has taken a leading role with inflows of $172.14 million, alongside other significant contributions from VanEck and Fidelity. This institutional support could foster a bullish recovery, encouraging a price resurgence despite current market fluctuations.

Looking ahead, Bitcoin’s trajectory is uncertain. A retest of support near $83,000 is anticipated, and a break below could trigger further declines to approximately $78,350. In contrast, if buyers regain momentum, a breakout rally may push Bitcoin towards the 61.80% Fibonacci retracement level, potentially reaching $95,350.

In summary, Bitcoin has encountered a significant price correction, dropping below $85,000 and experiencing marked liquidations. The technical analysis reveals a challenging resistance at $87,000, compounded by bearish momentum and market leverage shifts. Nevertheless, institutional inflows into Bitcoin ETFs suggest potential recovery paths. Observing the approaching support levels will be crucial in determining the next moves for Bitcoin in the evolving market landscape.

Original Source: coincentral.com

Post Comment