Bitcoin Price Analysis and Prediction for March 21

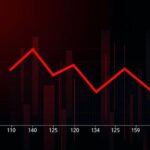

Bitcoin’s price has decreased by 2.23%, currently trading at $84,028 with sellers dominating the market. A false breakout at $83,358 suggests potential growth towards $85,000 or a downturn to $72,000-$76,000 if critical support fails. Sideways trading around $83,000-$85,000 is likely in the near term.

As of the latest assessment, Bitcoin (BTC) has experienced a decline of 2.23% in the past 24 hours, with a current trading price of $84,028. Data from CoinMarketCap indicates that sellers are currently exerting more influence than buyers.

On the hourly chart, Bitcoin has seen a false breakout from its local support level of $83,358. Should the daily candle close significantly below this threshold, it may pave the way for a potential increase towards the $85,000 range by the next day.

Examining the larger time frames, Bitcoin remains distant from its critical levels, exhibiting low trading volume. This suggests that neither buyers nor sellers are poised to take control of the market dynamics at this time.

In conclusion, the most probable scenario appears to be continued sideways trading between the $83,000 and $85,000 range. From a midterm perspective, should the price break below the key zone of $80,000, it may trigger a decline to the $72,000 to $76,000 range.

In summary, Bitcoin’s current trading situation presents a bearish sentiment due to stronger selling pressure and low trading volume. A false breakout from key support indicates potential volatility, although sideways trading is anticipated in the near future, particularly between the $83,000 and $85,000 levels. Traders should remain vigilant to any significant moves beyond these thresholds that could dictate the asset’s trajectory.

Original Source: www.tradingview.com

Post Comment