Risky Price Patterns Emerge for Bitcoin, Ethereum, and XRP Ahead of Triple Witching

Bitcoin, Ethereum, and Ripple have shown risky price patterns ahead of the upcoming triple-witching event, with Bitcoin slipping to $83,580, Ethereum below $2,000, and XRP down to $2.35. Market volatility is anticipated due to the expiration of over $4.5 trillion in contracts during this event, amid broader economic concerns.

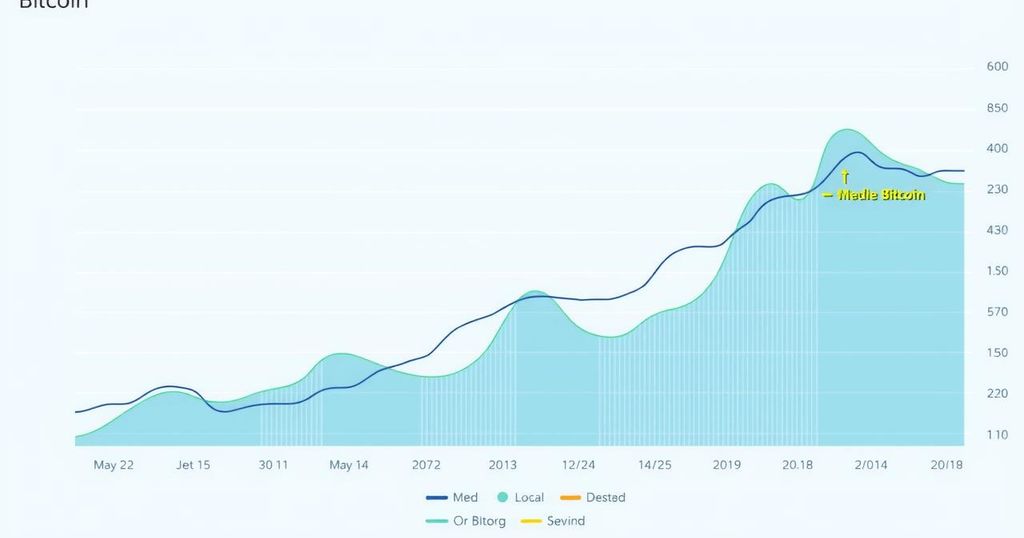

Recent price movements of leading cryptocurrencies, including Bitcoin, Ethereum, and Ripple, indicate the formation of troubling patterns in anticipation of the forthcoming triple-witching event. Bitcoin (BTC) has decreased to $83,580 from a weekly high of $87,158, while Ethereum (ETH) has fallen beneath the $2,000 mark. Ripple (XRP) has also declined from a peak of $2.59 to $2.35 during the same period.

The observed price fluctuations align with market participants’ anticipation of the quarterly triple-witching event on Wall Street, which occurs on the third Friday of March, June, September, and December. On this significant day, stock options, stock index futures, and index options all expire concurrently, exerting unique pressures on the market.

This upcoming triple-witching event will see the expiration of options and futures contracts exceeding $4.5 trillion. Historically, volatility is heightened before, during, and after these events for both stocks and cryptocurrencies. For instance, during the last triple-witching event, Bitcoin opened at $97,777, dropped to $92,200, and ended the day at $97,000.

Concerns surrounding Donald Trump’s tariffs add to the unease in the market. This event follows a recent muted interest rate decision from the Federal Reserve, where officials expressed concerns about stagflation while Jerome Powell suggested that inflationary pressures may be temporary. The Fed indicated potential reductions in its quantitative tightening measures soon.

Specifically, Bitcoin appears to have formed a rising wedge pattern characterized by ascending and converging trendlines. This pattern, combined with a double-top formation at $108,150 and a death cross observed on March 14, suggests a potential price drop, with a target around $76,890, corresponding to its March low.

Ethereum, in turn, has established a triple-top formation at $4,005, with a neckline located at $2,140. This bearish pattern can precipitate a significant downward movement, especially as the price has dropped below the neckline and both the 50-week and 200-week moving averages, indicating possible further declines to the psychological level of $1,500.

Additionally, XRP faces a risk of breakdown despite the conclusion of litigation with the SEC. The crypto has depicted a head and shoulders pattern, with a neckline at $1.93 and shoulders at $3. The failure to exceed the shoulders level this week places XRP at risk of falling below the neckline, potentially targeting a decline to $1.

In summary, Bitcoin, Ethereum, and Ripple are exhibiting concerning patterns as the triple-witching event approaches. Bitcoin has formed a rising wedge suggesting potential declines to $76,890. Ethereum’s triple-top may lead it towards $1,500, while XRP’s head and shoulders pattern poses a risk of falling to $1. Market volatility is expected to increase surrounding this significant financial event, necessitating caution among investors.

Original Source: crypto.news

Post Comment