Bitcoin Price Surge to $87,000 Triggers Significant Short Liquidations

Bitcoin’s price surge to $87,000 triggered significant short liquidations, leading to over $200 million in losses mainly from bearish traders. Major liquidations included $77.33 million from Bitcoin alone. Analysts forecast potential further price increases while Bitcoin whales engage in accumulation despite market volatility.

The recent surge of Bitcoin prices towards $87,000 has resulted in significant short liquidations, compelling many bearish traders to exit their positions at considerable losses. Over the past 24 hours, total market liquidations exceeded $200 million, heavily influenced by short positions. The surge appears to have triggered a classic short squeeze scenario, further bolstering Bitcoin’s ascent towards new price heights.

According to Coinglass, Bitcoin alone incurred liquidations totaling approximately $77.33 million, with $67.04 million attributed to short positions. For the broader crypto market, short positions accounted for around $143 million of the liquidated amount, reflecting traders’ bets against Bitcoin’s potential rise. Major exchanges such as Bybit and Binance reported the highest losses from these liquidations, with Bybit experiencing $32.65 million in BTC short liquidations.

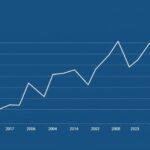

Currently, Bitcoin’s price has reached $87,415, marking a 3.65% increase within the last 24 hours, which correlates with heightened liquidation events among short traders. Previously, Bitcoin traded under $85,000, reflecting a volatile market atmosphere. Despite fluctuations, trading volumes remain robust, having increased by 124%.

Analysts express optimism regarding Bitcoin’s trajectory as it regains the $87,000 threshold, pinpointing the next critical resistance between $87,000 and $87,400. Predictions suggest that if Bitcoin surpasses this range, it could reach between $89,000 and $90,000, followed by further rallies potentially exceeding $92,000 to $93,000.

Amid this bullish momentum, Bitcoin whales are capitalizing on market dips, accumulating substantial amounts of Bitcoin. Reports indicate that these whales exhibit growing activity, suggesting confidence in future price surges. Recent charts indicate significant spikes in whale demand coinciding with price increases, emphasizing the strategic buying by these market players during price corrections.

In summary, Bitcoin’s recent price surge towards $87,000 has resulted in significant short trader liquidations, underscoring a classic short squeeze scenario. Major liquidations reached over $200 million, primarily affecting short positions, while whales demonstrate renewed interest amid this volatility. Analysts foresee a possibly bullish future for Bitcoin, with expectations of further upward momentum if key resistance levels are surpassed.

Original Source: bitcoinist.com

Post Comment