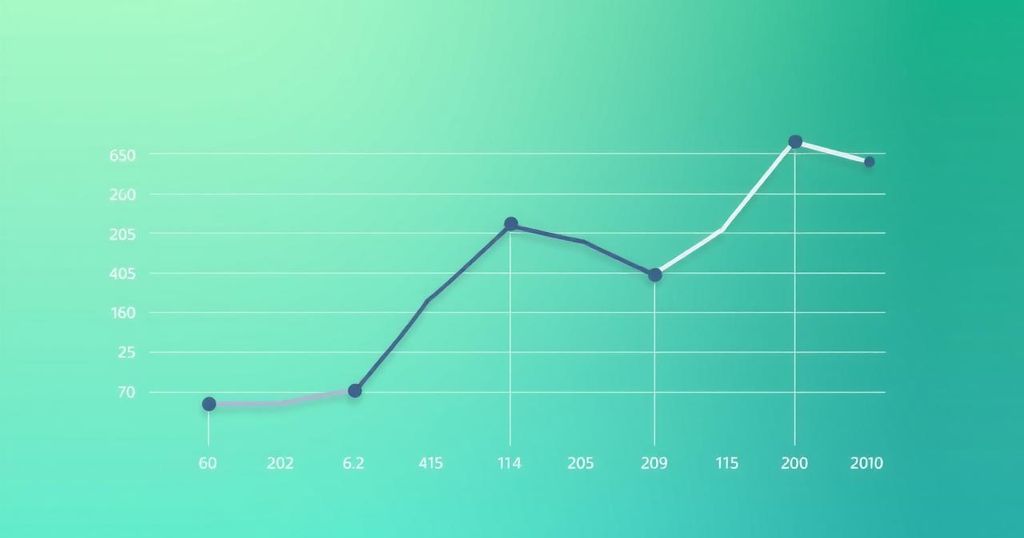

Stabilization of China’s 10-Year Bond Yield Amid Economic Adjustments

China’s 10-year bond yield stabilizes at 1.91% amid steady lending rates by the People’s Bank of China, with expectations of future rate cuts. The bond market is influenced by concerns over tariff negotiations and noted flexibility from former President Trump.

China’s 10-year government bond yield has stabilized around 1.91%, reflecting a recalibration of investor expectations concerning future monetary policy. This stabilization follows the People’s Bank of China’s decision to maintain key lending rates steady for five consecutive months in March, with the one-year Loan Prime Rate (LPR) at 3.1% and the five-year LPR at 3.6%, both of which are at historic lows.

The central bank has signaled intentions to potentially lower interest rates and modify the reserve requirement ratio at an appropriate time. In the midst of these developments, traders are exercising caution as the April 2 deadline set by former President Trump for reciprocal tariffs approaches. However, his suggestion of ‘flexibility’ in tariff implementation has instilled hope for a more targeted tariff strategy, possibly alleviating market uncertainties.

In conclusion, the stabilization of China’s 10-year bond yield signifies a shift in market sentiment as investors reevaluate anticipated monetary policies. With the People’s Bank of China adopting a cautious approach to interest rates while considering future adjustments, and the dynamics surrounding impending tariffs, market participants remain vigilant. Overall, the bond yield reflects a complex interplay of domestic economic factors and international trade policies.

Original Source: www.tradingview.com

Post Comment